Most forms are in Adobe Acrobat PDF format.

![]() You

will need Adobe Reader to view and print these forms. If you do not

already have Adobe Reader installed on your computer, you may

download the software for free.

You

will need Adobe Reader to view and print these forms. If you do not

already have Adobe Reader installed on your computer, you may

download the software for free.

![]()

![]()

Tax School Home Page click here

Student Instructions:

Print this page, work on the questions and then submit test by mailing the answer sheet or by completing quiz online.

Instructions to submit quiz online successfully: Step-by-Step check list

Most forms are in Adobe Acrobat PDF format.

![]() You

will need Adobe Reader to view and print these forms. If you do not

already have Adobe Reader installed on your computer, you may

download the software for free.

You

will need Adobe Reader to view and print these forms. If you do not

already have Adobe Reader installed on your computer, you may

download the software for free.

In this "Filing Basics" tax school part 1, we will review some tax rules that affect every person who may have to file a federal income tax return. We will cover topics such as who must and should file, what filing status and how many exemptions to use. In addition, this tax topic is about the standard deduction and taxpayers who do not itemize their deductions.

Please use the IRS Publication 501 to complete this tax assignment.

| Publication |

Page # |

Time |

2. You must provide over half of the cost of keeping up a home for a child, parent, or other qualifying relative to file as "Head of Household."

True False

| Publication |

Page # |

Time |

3. If you are married, you could be considered unmarried for Head of Household purposes.

True False

| Publication |

Page # |

Time |

4. To qualify for Head of Household, one must have maintained a home mainly for

A. A

child or a parent

B. An

aunt or a cousin

C. Only a

parent

D. Only

a child

| Publication |

Page # |

Time |

5. If a taxpayer is married, he must file jointly.

True False

| Publication |

Page # |

Time |

6. What are the five Filing Status' for tax year 2008 in the order that you see them on tax forms?

A. Single, Married filing jointly, Married filing separately, Head of

household, and Qualifying Widow(er).

B. Single, Married filing separately, Married Filing jointly, Head of household,

and Qualifying Widow(er).

C. Single, Head of household, Married filing jointly, Married filing separately,

and Qualifying Widow(er).

D. Single, Married filing jointly, Married filing separately, Qualifying widow(er) and Head of household.

| Publication |

Page # |

Time |

7. A person who is single, is living alone, and has no dependents can file as Head of Household.

True False

| Publication |

Page # |

Time |

8. Esteban and his wife have been separated since May. They are not yet divorced. She has one child living with her. Esteban also has a child living with him. Of the following choices, what is the filing status that would not be possible for neither Esteban nor his wife?

A. Single

B. Married filing jointly

C. Married filing separate

D. Head of Household

| Publication |

Page # |

Time |

9. Jose is the only person maintaining a household for his father. He paid for all his father's upkeep. To claim him as a dependent, his father must be a resident of which of the following countries?

A. United States

B. Mexico

C. Canada

D. Any of the above

| Publication |

Page # |

Time |

10. In order for a dependent to qualify you for the Head of Household filing status, the dependent that you claim can

A. Be your child who lived with you for at least 6 months of the year.

B. Be your parent who does not need to live with you any part of the year.

C. Be your aunt who lived with you for at least 6 months of the year.

D. Any of the above

| Publication |

Page # |

Time |

11. Which of the following does NOT meet the requirements to claim the Head of Household filing status?

A. Your spouse did NOT live in your home during the last 6 months

of the tax year.

B. You paid more than half of the cost of keeping up your home for the entire

year.

C. You are unmarried or considered unmarried on the last day of the year.

D. Your home was the main home for your foster child for only 5 months of the tax

year.

| Publication |

Page # |

Time |

12. For Head of Household purposes, if your parent is your qualifying relative and he or she does not live with you, you must pay more than half the cost of keeping up a home for the year.

True False

| Publication |

Page # |

Time |

13. For tax year 2008, please identify the 'Standard Deduction' amount for Married Filing Jointly:

A. $ 3,500 Federal.

B. $ 5,450 Federal.

C. $ 8,000 Federal.

D. $ 10,900 Federal.

| Publication |

Page # |

Time |

14. If you and your spouse file separately, and your spouse itemizes her deductions, you must

A. Itemize your deductions also

B. Use the standard deduction instead

C. Tell her that she can't itemize because you are claiming the standard deduction

D. Split income between the two

| Publication |

Page # |

Time |

15. If your spouse died in 2008, you can use the _______ filing status for tax year 2008, because it is more advantageous to do so.

A. Single

B. Married Filing Jointly

C. Married Filing Separate

D. Qualifying Widow(er) With Dependent Child.

| Publication |

Page # |

Time |

16. If you were married on or before December 31, 2008, what can your filing status be for tax year 2008?

A. Single

B. Married Filing Jointly

C. Married Filing Separate

D. Both B and

C are correct

| Publication |

Page # |

Time |

17. Hector was widowed before January 1, 2008. He did not remarry in tax year

2008, and he did not have a child living with him. What is the only filing

status that Hector can use?

A. Single

B. Married Filing Jointly

C. Married Filing Separate

D. Qualifying Widow(er) With Dependent Child.

| Publication |

Page # |

Time |

18. To qualify for 'Qualifying Widow(er) With Dependent Child' filing status, you must

A. Have a qualifying child living with you

B. Have not remarried by the end of the year

C. Have paid more than half of the cost of keeping up a home for your child

D. All of the above

| Publication |

Page # |

Time |

19. Henry wants to claim his aunt on his return. His aunt lives in Mexico and does not qualify for a social security number. How does Henry claim an exemption for her if she doesn't have a valid social security number?

A. He can obtain an individual taxpayer identification number from the IRS.

B. He can get her

a fake number.

C. He can write "Applied For" in the social security number column.

D. Since she lives in Mexico a number is not required.

| Publication |

Page # |

Time |

20. What is the Head of Household standard deduction amount for tax year 2008? (for most people).

A. $3,500 Federal.

B. $5,450 Federal.

C. $10,900 Federal.

D. $8,000 Federal.

| Publication |

Page # |

Time |

21. If at the end of the tax year, you are married and living together, you can file

A. Married filing separate

B. Married filing jointly

C. Single

D. Both A and B are correct

| Publication |

Page # |

Time |

22. If a husband and his wife file Married Filing Separate, they

A. Split their wages in half

B. Both

sign each other's return

C. Both report only their own income, exemptions, credits and deductions on

their

individual returns.

D. File as Head of Household although they did not live apart at any time during the year.

| Publication |

Page # |

Time |

23. Mary's spouse, Joseph, died in an auto accident in 2007. Mary had not remarried and she supported their 5-year-old son all year. She qualifies to use the 'Qualifying Widow(er) With Dependent Child' filing status on her Federal return for the tax year 2008.

True False

| Publication |

Page # |

Time |

24. One of the requirements to be able to file under the 'Qualifying widow(er) With Dependent Child' filing status is that

A. You use 'Qualifying Widow(er) With Dependent Child' filing status in the year your spouse died.

B. You use 'Qualifying Widow(er) With Dependent Child' filing status for next 2 years that does not include

the year of spouse's death

C. You use 'Qualifying Widow(er) With Dependent Child' for third year of spouse's death

D. You use 'Qualifying Widow(er) With Dependent Child' even if you remarry in that year.

| Publication |

Page # |

Time |

25. If your child is considered temporarily absent from home. You can still claim him as living with you if he is away because of

A. Illness

B. Education or business

C. Vacation or military service

D. Any of the above

| Publication |

Page # |

Time |

26. If your filing status is Married Filing Separate, you CANNOT take the earned income credit.

True False

| Publication |

Page # |

Time |

27. Once you file a joint return, you CANNOT choose to file separate returns for that year after the due date of the return.

True False

| Publication |

Page # |

Time |

28. If you or your spouse (or both of you) filed a separate return, you generally can change to a joint return any time within 3 years from the due date of the separate return or returns.

True False

| Publication |

Page # |

Time |

29. You are considered married for Head of Household purposes if your spouse was a nonresident alien at any time during the year and you do not choose to treat your non-resident spouse as a resident alien.

True

False

| Publication |

Page # |

Time |

30. What is the 'Standard Deduction' amount for a single dependent who earned $4,000 from his/her job in tax year 2008?

A. $4,000 Federal.

B. $900 Federal.

C. $4,300 Federal.

D. $5,450 Federal.

| Publication |

Page # |

Time |

31. One of the following does not meet the test that is required to be a qualifying child for Head of Household filing status.

A. The child must be your son, daughter, stepchild, foster child, brother,

sister, half brother, half sister, stepbrother, stepsister, or a descendant of

any of them.

B. The child must be (a). under the age of 19 at the end of the year, (b). Under

the age of 24 at the end of the year and full-time student, or (c). any age if

permanently and totally disabled.

C. The child provided more than half of his or her own support for the year.

D.

The child must have lived

with you for more than half of the year.

| Publication |

Page # |

Time |

32. What is/are the exemption amounts for tax year 2008?

A. Federal exemption amount is $3,500.

B. Personal exemption amount is $99 and spousal exemption amount is

also $99.

C. Dependent exemption amount is $5,450.

D. All of the above are correct.

| Publication |

Page # |

Time |

33. What are two types of exemptions?

A. Business and Investment exemptions.

B. Personal

exemptions and exemptions for dependents.

C. Joint return and Gross Income exemptions.

D. Single and Married exemptions.

| Publication |

Page # |

Time |

34. If you are a U.S. citizen or resident alien, whether you must file a federal income tax return depends on

A. Your gross income.

B. Your filing status.

C. Your age and whether you are dependent or not.

D. All of the above.

| Publication |

Page # |

Time |

35. You may have to pay a penalty if you are required to file a tax return but fail to do so. If you willfully fail to file a tax return, you may be subject to criminal prosecution.

True False

| Publication |

Page # |

Time |

36. If your parent (or someone else) can

claim you as a dependent, and you were not age 65 or older or blind, you must

file a return if

A. Your unearned income was more than $900.

B. Your earned income was more than $5,450.

C. Your gross income was more than the larger of $900 or your earned income (up

to $5,150) plus $300.

D. Any of the above.

| Publication |

Page # |

Time |

37. For 2008, you must file a return if

A. You owe any special taxes, such as Alternative minimum tax, additional tax

on qualified plans, and social security or Medicare tax on tips you did not

report to your employer.

B. You received any advanced earned income credit (EIC) payments from your

employer.

C. You had net earnings from Self-employment of at least $400 or wages of

$108.08 or more from a church or qualified church-controlled organization exempt

from employer social security and Medicare taxes.

D. Any of the above.

| Publication |

Page # |

Time |

38. To qualify for Head of Household status, you must pay more than half of the cost of keeping up a home for the year.

True False

| Publication |

Page # |

Time |

39. Mirtha is an unmarried woman for tax year 2008. Her unmarried son lived with her all year and he was 18 years old at the end of the year. He did not provide more than half of his own support and does not meet the tests to be a qualifying child of anyone else. As a result, Mirtha's filing status can be

A. Single.

B. Married Filing Separately.

C. Head of Household.

D. Qualifying Widow(er) With Dependent Child.

| Publication |

Page # |

Time |

40. You can claim an exemption for a qualifying child or qualifying relative only if the following test is met.

A. Dependent taxpayer test.

B. Joint return test.

C. Citizen or resident test.

D. All of the above.

| Publication |

Page # |

Time |

Here we will review tax rules to follow in claiming the earned income credit (EIC). The earned income credit (EIC) is a tax credit for certain people who work and have earned income. This usually means more money in your pocket and a reduction in the amount of of tax you owe.

Please use IRS Publication 596 to complete this assignment.

| Publication |

Page # |

Time |

42. You don't want to wait to receive the EIC, you expect to be eligible for the EIC for tax year 2009, so to receive the EIC in advance in tax year 2008, you

A. Call the IRS and tell them you believe you qualify

B. File your return ahead of time

C. You don't qualify so don't try

D. Give Form W-5 to your employer to get part of EIC credit during the year in

advanced payments.

| Publication |

Page # |

Time |

43. Which of the following conditions would NOT prevent an individual from qualifying for the Earned Income Credit for tax year 2008?

A. "Married Filing Separately" filing status.

B. Being a qualifying child of another person.

C. Being age 25.

D. Investment income of more than

$2,950.

| Publication |

Page # |

Time |

44. What will happen if your spouse does not have a social security number?

A. The IRS will advise you to write "Applied For" in the social security section.

B. You CANNOT get the EIC.

C. The IRS will ask you for the correct information for sure.

D. You will get credit anyways because it only matters that your child has a correct number

| Publication |

Page # |

Time |

45. If you are married, in order to qualify for the EIC, your filing status cannot be

A. Single

B. Married Filing Jointly

C. Married Filing Separately

D. Head of Household

| Publication |

Page # |

Time |

46. To qualify for the Earned Income Credit in tax year 2008, your investment income must not be over

A. $ 2,950

B. $ 2,850

C. $ 2,900

D. $ 2,700

| Publication |

Page # |

Time |

47. The credit is called the Earned Income Credit because to qualify you must

A. Be at poverty level

B. Have money in your savings

C.

Work and have earned income

D. Not be living in luxury

| Publication |

Page # |

Time |

48. If you retire on disability, benefits you receive under your employer's disability retirement plan (for EIC purposes) are

A. Always taxable

B. Unearned income

C. Not counted because disability is not taxable.

D. Considered earned income until you reach minimum retirement age

| Publication |

Page # |

Time |

49. Income that is not earned income includes all of the following EXCEPT

A. Net earnings from self-employment

B. Earnings while an inmate in a penal institution.

C. Welfare benefits.

D. Interest and dividends.

| Publication |

Page # |

Time |

50. To qualify for the earned income credit with a qualifying child, you must meet 3 tests which are

A.

Joint return test, age, and Residency tests.

B.

Citizenship, Age and Qualifying relative test.

C.

Relationship, Age, and Residency tests.

D.

None of the above.

| Publication |

Page # |

Time |

51. Having a qualifying child who lives with you in your home for more than 6 months meets what test?

A. Age test

B. Relationship test

C. Residency test

D. Gross income test

| Publication |

Page # |

Time |

52. If your Earned Income Credit was denied, send Form 8862 if it was denied because

A. You loaned your dependents to your friend.

B. You claimed a dependent that was not yours.

C. You and your spouse each tried to claim the earned income credit.

D. Any of the above.

| Publication |

Page # |

Time |

53. Your qualifying child is your son, daughter, adopted child, grandchild, or stepchild who at the end of the year

A. Was any age if permanently and totally disabled.

B. Was under age 19.

C. Was under 24 and a student.

D. Any of the above.

| Publication |

Page # |

Time |

54. Your son was a qualifying child of his father whom had a higher AGI. Your son lived with both parents the same amount of time and is a qualifying child for both of you. Then,

A. Your son's father can claim the credit because he had a higher AGI.

B. Both parents can claim the credit.

C. You and your child's father can decide which of you will take the EIC.

D. The one with the lower income can claim

the credit because he or she needs it most.

| Publication |

Page # |

Time |

55. If you are a qualifying child of another person

A. You cannot claim the EIC.

B. You can claim the EIC as long as the other conditions are met.

C. You can claim the EIC if you qualify.

D. You can claim the EIC as long as you have children.

| Publication |

Page # |

Time |

56. If your EIC for any tax year after 1996 was denied or reduced for any reason other than for a mathematical or clerical error, you must

A. Re-do your return with the correct information.

B. Not try to get the EIC credit for 5 years.

C. Attach a completed Form 8862 to your next tax return to claim the EIC.

D. Not try to get the EIC for 15 years.

| Publication |

Page # |

Time |

57. You claimed the EIC on your 2007 tax return which you filed March 2008. In October 2008, the IRS denied your claim and determined that your error was due to reckless or intentional disregard for the EIC rules. As a result,

A. You cannot claim the earned income credit for tax year 2009.

B. You cannot claim the credit for tax years 2008 and 2009.

C. You cannot claim the credit for tax years 2009 through 2018.

D. You can't claim the credit for tax year 2019.

| Publication |

Page # |

Time |

58. If you claimed the EIC on your 2007 tax return, which was filed in February 2008, and in December 2008, the IRS denied your claim and determined that your error was due to fraud, then

A. You can't claim the credit for tax year 2009.

B. You can't claim the credit for tax year 2008 or 2009.

C. You can't claim the EIC

for tax year 2008.

D. You can't claim the EIC

for 2008 through 2017.

| Publication |

Page # |

Time |

59. You can receive part of your EIC in your paycheck by completing form W-5 and

A. Mailing the lower part of the form to the IRS.

B. Giving the lower part of the form to only one employer.

C. Call the IRS and explain your financial situation to a taxpayer advocate.

D. Give the form W-5 to all your employers.

| Publication |

Page # |

Time |

60. To get part of the earned income credit paid to you throughout the year in your paycheck, you must

A. Expect to have a qualifying child.

B. Expect that your earned income and modified adjusted gross income will

be less than $35,463 ($38,583 if you expect to file 'Married Filing Jointly' for

tax year 2009).

C. Expect to be eligible for the EIC

for tax year 2009.

D. All of the above

| Publication |

Page # |

Time |

61. What should you do if you have more than one employer and you would like to receive the advanced EIC payments?

A. Give a Form W-5 only to one employer

B. Give a Form W-5 to all of your employers

C. Send Form W-5 to the IRS

D. Fill out W-4 and claim fewer exemptions

| Publication |

Page # |

Time |

62. If you receive advanced EIC payments in year 2008, you must

A. File a 2008 tax return only if you think they would find out.

B. File a 2008 tax return, even if you would not otherwise have to file.

C. File a 2008 tax return only if you earned enough to file.

D. File a return only if you can't determine if you have to file.

| Publication |

Page # |

Time |

63. What is the amount of the Earned Income Credit you qualify for in tax year 2008 if you have two qualifying children and you earned $9,810 in wages and have no other income and your filing status is married Filing jointly.

A. $3,930

B. $2,917

C. $234

D. $3,910

| Publication |

Page # |

Time |

64. In 2008, you were 24, single, and living at home with your parents. You worked and were not a student. You earned $7,500. Your parents cannot claim you as a dependent. When you file your return, you

A. Can claim the Earned Income Credit because although you are not 25 yet, no

one can claim you as a dependent.

B. Can claim the Earned Income Credit because you earned less than $12,880 and

it does not matter that you are not at least age 25.

C. Live with your parents so you don't qualify for the Earned Income Credit

because your parents will already have claimed a credit.

D. Cannot claim the Earned Income Credit because you are not at least age 25.

| Publication |

Page # |

Time |

65. If you are 'Married Filing Jointly' and you have more than one qualifying child, to qualify for the EIC your income must be less than

A. $38,646

B. $15,880

C. $36,995

D. $41,646

| Publication |

Page # |

Time |

66. In tax year 2008, you were age 25, single, and living at home with your parents. You earned $7,500. Your parents can't claim you as a dependent. You can claim the EIC because

A. You are not a dependent of another person.

B. You are over 25 years of age.

C. You are not using married filing separate filing status.

D. All of the above.

| Publication |

Page # |

Time |

67. Your son is a qualifying child of both you and your son's father, because your son meets the relationship, age and residency tests for both you and your son's father. The father's AGI was more than yours. You and your son's father cannot agree on who would claim the EIC and your son lived with both of you the same amount of time during the year. Who can claim the EIC?

A. Both you and your son's father can claim the Earned Income Credit at the

same time.

B. You can claim the credit because you are the mother and that is all that

matters.

C. You can claim the Earned Income Credit as long as the child lives with you

and it does not matter if you earned less money.

D. Your son's father is able to claim the Earned Income Credit because he earned

more money.

| Publication |

Page # |

Time |

68. You and your son lived with your mother all year. You were over 25 year of age. Your income is only $23,000 from your job. Your mother's only income is $26,000 from her job. Your child meets the relationship, age, and the residency tests for both you and your mother. If you and your mother cannot agree on who will take the EIC, then who can take the EIC?

A. Your mother because her income was higher.

B. Your mother because she is your superior.

C. Your mother because you and your son lived in her household.

D. You because the child is your son.

| Publication |

Page # |

Time |

69. You and your sister shared a household for the entire 2008 tax year. You have five children who lived in the same household. You earned $20,000, and she earned $35,000. If you and your sister don't agree on who can claim the EIC, then your sister cannot claim the Earned Income credit because

A. You didn't sign Form 8332.

B. You are the children's parent and using the tie-breaker rule, you have the

right to not let her claim the EIC credit.

C. She earned more money and had a higher AGI and therefore she does not need

the extra money.

D. She did not care for the children as her own.

| Publication |

Page # |

Time |

70. Earned income to meet the EIC income rules include all of the following, EXCEPT:

A. Wages, salaries, and tips.

B. Net earnings from self-employment.

C. Gross income received as a statutory employee.

D. Interest earned from your savings account.

| Publication |

Page # |

Time |

71. U.S. Military personnel stationed outside the United States on extended active duty are not considered to have lived in the United States during that duty period for purposes of EIC rules.

True False

| Publication |

Page # |

Time |

72. The Residency Test for purposes of the EIC rules means that the qualifying child lived only in the U.S. for more than half of the tax year. (Not to be confused with the residency test for dependents).

True False

| Publication |

Page # |

Time |

73. Welfare benefits are considered earned income for purposes of receiving the Earned Income Credit.

True False

| Publication |

Page # |

Time |

74. Your child can be qualifying child of another person (whom is not the father or mother) with a higher modified AGI and that person can claim the EIC if you don't agree on who will claim it.

True False

| Publication |

Page # |

Time |

75. If you do not have a valid social security number and you write "NO" directly on 64a of Form 1040 or line 40a (Form 1040A) or line 8a (Form 1040EZ), then

A. You can claim the EIC.

B. You cannot claim the EIC.

C. You cannot send in your tax return.

D. You can claim the EIC as long as you have a valid IRS ITIN Number.

| Publication |

Page # |

Time |

76. Social security and railroad retirement benefits are not considered earned income for purposes of the Earned Income Credit rules

True False

| Publication |

Page # |

Time |

77. Unemployment compensation is considered earned income for EIC purposes because in order to receive unemployment compensation you are required to work.

True False

| Publication |

Page # |

Time |

78. For Earned Income Credit purposes, the child's age does not matter if the child is permanently and totally disabled at any time during the tax year.

True False

| Publication |

Page # |

Time |

79. Even if you have an approved Form 4029, all wages, salaries, tips and other employee compensation counts as

A. Military income

B. Unearned income

C. Earned income

D. None of the above

| Publication |

Page # |

Time |

80. Your filing status is 'Married Filing Jointly' and you have only one qualifying child living with you for tax year 2008. Your earnings from work are a total of $33,010, and you have no other income. What is your Earned Income Credit amount?

A. $ 1,173

B. $ 634

C. $ 1,184

D. $ -0-

| Publication |

Page # |

Time |

In this tax school part, you will learn when and when you cannot take the child and dependent care expenses credit. We will explain how to figure the credit. You may be able to claim the credit if you pay someone to care for your dependent who is under age 13 or for your spouse or dependent who is not able to care for himself or herself. To qualify, you must pay these expenses so you can work or look for work.

Please study IRS Publication 503 to complete the following questions.

81. If you pay someone to come to your home and care for your dependent or spouse,

A. You may be a household employer

B. You may have to pay employment taxes

C. You can claim the credit for child and dependent care expenses

D. Any of the above

| Publication |

Page # |

Time |

82. To claim the Child and Dependent Care Expenses Credit, you must file ______ if you file Form 1040, or ______ if you file Form 1040A.

A. Form 2441 or Schedule 2.

B. Form 2106 or Schedule 3.

C. Form 4567 or Schedule 1.

D. None of the above.

| Publication |

Page # |

Time |

83. To qualify for child and dependent care expenses credit, you

A. Can pay for care so that you will be able to go on vacation

B. Can hire your child who is under 19 years old

C. Can hire your aunt whom you can claim as a dependent

D. Must have a child that must live with you for more than half of the year and

meet other requirements.

| Publication |

Page # |

Time |

84. To claim the Child and Dependent Care Credit, you (and your spouse if you're married) must have earned income. Your spouse is treated as having earned income for any month that he or she is

A. A full-time student.

B. Physically not able to care for himself or herself.

C. Mentally not able to care for himself or herself.

D. Any of the above.

| Publication |

Page # |

Time |

85. Generally, married couples must file a joint return to take the child and dependent care credit. You may be able to file a separate tax return and still take the credit if

A. You are legally separated.

B. You are living apart

from your spouse.

C. Your spouse signs an agreement not to claim the credit.

D. Both A and B above.

| Publication |

Page # |

Time |

86. Your child and dependent care expenses must be for the care of one or more qualifying persons such as

A. A child who is under 18 years-old when the care was provided.

B. Your dependent daughter who was under the age of 13 when the care was

provided.

C. Your parents who are perfectly able to care for themselves.

D. A person who did not live with you.

| Publication |

Page # |

Time |

87. You take your 4-year-old child to nursery school that provides lunch and a few educational activities as part of its pre-school child-care service. Which one of the following would be correct?

A. You can count the total cost as child care because the costs were partly to provide

education.

B. You can count the total cost when you figure the child and dependent care

credit because lunch and educational activities are incident to the childcare

and the cost cannot be separated.

C. Expenses were for child's lunch so they do count.

D. All of the above

| Publication |

Page # |

Time |

88. You pay a nanny to care for your 2-year-old son and 4-year-old daughter so you can work. You become ill and miss 4 months of work but received sick pay. You continue to pay the nanny to care for the children while you are ill.

A. Your absence is not a short temporary absence, and your expenses are not

qualifying care expenses because they are not work related.

B. Your absence is a short temporary absence, and your expenses are

qualifying care expenses.

C. An absence of 6 months or less is a short, temporary absence

D. An absence of more than 2 weeks may never be considered a short,

temporary absence regardless of the circumstances.

| Publication |

Page # |

Time |

89. You place your 12 year old child in a boarding school so you can work full-time. Which of the following would be correct?

A. You can only count the educational part of the boarding costs as

qualifying expenses

B. You can't count the boarding cost because it was not for a pre-school child

C. You can count that part of the expense in figuring your child and dependent

care credit, if it can be separated from the cost of the education

D. If you place your child in boarding school, he will be away from the home

and thus you can't claim the care credit

| Publication |

Page # |

Time |

90. The work related expenses for the 'child and dependent care expenses care credit' are expenses that

A. Are for the cost of a babysitter while you and your spouse go out to eat.

B. Are not really for the qualifying person's care

C. Allow you to work or look for work

D. Allow you to go on vacation from work

| Publication |

Page # |

Time |

91. If your spouse is a student or is not able to care for him or herself, he or she is treated as having earned income for any month that he or she is

A. Not your

dependent even if her or she lived in your home.

B.

A partially disabled spouse capable of caring for him or herself.

C. Physically or mentally not able to care for him or herself or is a full

time student

D. A student that is attending full time only at night

| Publication |

Page # |

Time |

92. You can count child care expense payments you make to relatives who are

A. Not your dependents, even if they live in your home.

B. Your children who are under 19 years old, as long as they not your

dependents.

C. Your dependents for whom you (or your spouse) can claim an exemption.

D. Any of the above.

| Publication |

Page # |

Time |

93. You, a single taxpayer, paid work related child care expenses of $3,000 in tax year 2008. You were reimbursed $2,400 by a state social services agency. Which of the following is correct regarding the child and dependent care expenses credit? (two qualifying dependents).

A. Since you were reimbursed, you can't take the child and dependent care

expenses credit

B. You can use $1,000 to figure your credit

C. You can use $600 to figure your credit

D. You can use $2,600 to figure your credit

| Publication |

Page # |

Time |

94. If the care provider information you give is incorrect or incomplete, your credit will not be allowed unless you

A. Provide the correct information.

B. Show proof that you did pay.

C. Show due diligence in trying to supply the correct information by keeping

the care provider's completed Form W-10.

D. Call the IRS and give them the telephone number of the care provider.

| Publication |

Page # |

Time |

95. There are many ways the taxpayer can show due diligence. Which of the following is correct as far as showing due diligence?

A. Get and keep the care provider's completed Form W-10.

B. Show a copy of the statement furnished by your employer if the the provider

is your employer's dependent care plan.

C. Show a letter or invoice from the provider if it shows the necessary

information.

D. Any of the above

| Publication |

Page # |

Time |

96. There is a dollar limit on the amount of your work related expenses that you can use to figure the child and dependent care expenses credit. This limit is set per qualifying person. The limit is

A. $3,000 for one qualifying person.

B. $6,000 for two or more qualifying people.

C. $3,000 for each qualifying person.

D. Both A and B are correct.

| Publication |

Page # |

Time |

97. You and your spouse (MFJ) paid $5,000 in child care, you earned $19,000 for the entire year. Your spouse did not work and was not a student or disabled. You have only one qualifying child. What is your child and dependent care expenses credit for tax year 2008?

A. $0 federal credit.

B. $990 federal credit.

C. $960 federal credit.

D. $1,600 federal credit.

| Publication |

Page # |

Time |

98. If I am single and want to file my return and have no tax liability. If I claim the child and dependent care expenses credit for federal, would I get a refund?

A. Yes, tax liability can be zero, and you can still qualify because for

federal the

credit is refundable.

B. No, you cannot get a refund for any part of the credit that is more than

your regular tax because this tax credit is not refundable.

C. No, if you have tax, the child and dependent care credit would not cancel it and

thus there is no reason to claim it.

D. No, the federal tax system does not have a Child and Dependent Care Expenses Credit.

| Publication |

Page # |

Time |

99. Juan and Maria Escobedo are married and keep up a home for their two pre-school children. In tax year 2008, they claimed their children as dependents. Juan earned $15,200 and Maria earned $5,100. They paid $4,900 in work related child care expenses. What is their credit?

A. $-0- for federal.

B. $501.76 for federal.

C. $1,632 for federal.

D. $1,568 for federal.

| Publication |

Page # |

Time |

100. The amount of child and dependent care credit you can claim is limited to your regular tax.

True False

| Publication |

Page # |

Time |

101. In tax year 2008, if you are single with one qualifying child and your gross income is $40,100, what would your federal be if you paid $4,000 in child care?

A. $660.

B. $1,280.

C. $3,000.

D. $-0-.

| Publication |

Page # |

Time |

102. If your qualifying person is a nonresident or resident alien who does not have and cannot get a social security number (SSN), then you are not able claim a child and dependent expenses credit for that person.

True False

| Publication |

Page # |

Time |

103. In tax year 2008, to qualify for the federal child and dependent care credit, your adjusted gross income must be less than

A.

$70,000

B.

$43,000

C.

$100,000

D. There is no income limit.

| Publication |

Page # |

Time |

104. You paid a fee to an agency to get the services of the nanny who cares for your 2-year-old daughter while you work. The fee you paid for the nanny search is NOT a work-related expense for the child and dependent care expenses credit.

True False

| Publication |

Page # |

Time |

105. For purposes of claiming the Child and Dependent Care Expenses Credit, if your child turns age 13 during the year

A. The child is not a qualifying person because he has to have been under age

13

at the end of the year.

B. The child's age does not matter as long as he is your dependent.

C. The child is a qualifying person only for the qualifying expenses paid when

he or she was under age 13 for federal.

D. The child is not a qualifying child because the child has to be in pre-school.

| Publication |

Page # |

Time |

106. In tax year 2008, Ramon's wife did not work all year because she was not able to care for herself. They are filing jointly. Ramon worked and earned $21,100. They have one qualifying child for the Child and Dependent care credit. They paid $2,000 for care of the child. How much credit can they qualify for?

A. Federal $0.

B. Federal $744.

C. Federal $640.

D. Federal $620.

| Publication |

Page # |

Time |

107. Kevin's girlfriend claimed his son on her tax return. His son lived with her all year. Kevin paid for his child care expenses a total of $2,200. Can Kevin claim the Child and Dependent care Expenses Credit?

A. No, because he is not his dependent. Besides he did not live in his home at

all and therefore not the custodial parent.

B. Yes, because he passes the relationship test

C. Yes, because he paid for the child care expenses

D. Yes, because they (Kevin and his girlfriend) signed Form 8332

| Publication |

Page # |

Time |

108. If you are the non-custodial parent, for purposes of claiming the child and and dependent care credit, the child can be your qualifying child.

True False

| Publication |

Page # |

Time |

109. If you and your qualifying person did not live in the same home for more than half of the year, other than for reasons because of birth, death or temporary absences, you are able to claim the child and dependent care expenses credit.

True False

| Publication |

Page # |

Time |

110. For purposes of the child and dependent care expenses credit, if your spouse was permanently and totally disabled and you have two qualifying children he or she is considered to have earned $500 per month for the time that he or she was disabled.

True False

| Publication |

Page # |

Time |

In this tax school part, you will be able to review your tax knowledge you have in tax preparation. You will be able to apply knowledge you have integrated with new knowledge.

Use publication IRS Publication 17 to complete this topic.

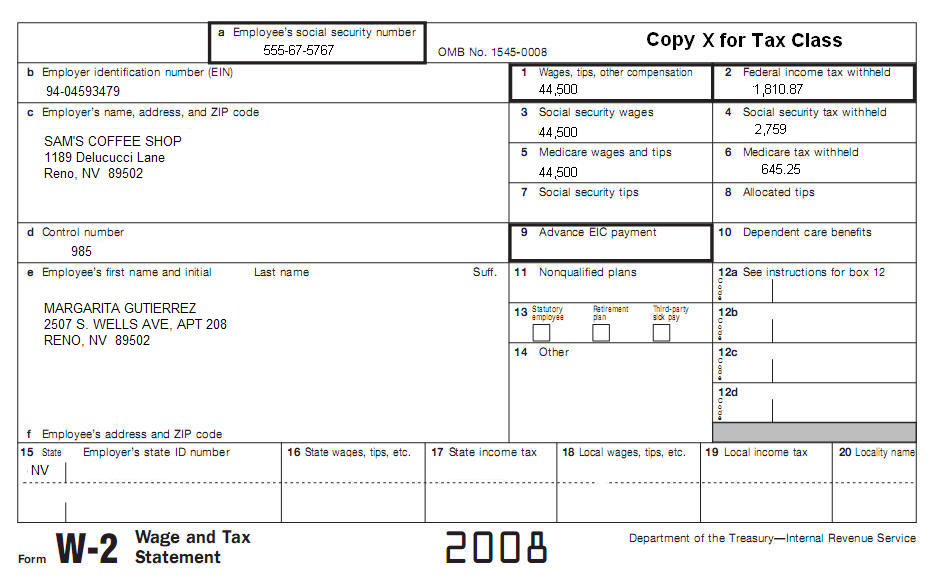

Prepare the appropriate Federal forms for Margarita Gutierrez. Her address is current on Form W-2. Get all her basic information from the following W2, including income information.

Margarita (DOB 09/10/1966) is a divorced woman. For tax year 2008 she received the following:

| Unemployment Compensation $ 985 | |

| Interest from First Bank $414 | |

| Lottery winnings: $ 911 |

Margarita has three children:

| Carlos Tovar, DOB August 6, 2002 (SSN 555-76-7755) | |

| Anita Tovar, DOB September 15, 2001 (SSN 555-76-7754) | |

| Javier Tovar, DOB December 31, 1991 (SSN 555-76-7753) |

Margarita paid rent $8,800 for tax year 2008.

March 12, 2008, Margarita placed a deposit of $180 ($90 for each child) with a care provider to reserve a place for her two children Carlos and Anita in the child care facility. Her plans were for the facility to care for her children until her mother suggested that it would be great for her (Margarita's mother) to take of the children. As a result, Margarita forfeited her deposit.

In 2008, Margarita paid her mother Linda Gutierrez $ 2,100 ($1,050 for each child) for child care. Linda lives at 1965 S. Virginia St., Reno, NV 89502. Her number is 912-52-1060. Linda cared for both children.

Margarita is the only person that can claim the children. The children lived with her for all of 2008 tax year. She paid all of the household expenses and she was the only person supporting her children.

Margarita's son Javier turned 17 on December 31, 2008. He is a U.S. Citizen and Margarita can claim him as a dependent. Margarita was told by another preparer that she can get the child tax credit for Javier because Javier was 16 years old for the most part of the tax year.

In 2008, Margarita bought a new car for $ 9,000 cash and received a $ 400 rebate check from the manufacturer.

Margarita received $ 3,000 in court ordered alimony payments from her ex-husband Francisco Tovar (SSN 540-16-7021) as specified in her divorce decree .

In 2008, Margarita makes a payment directly to an eligible educational institution for her son Javier's qualified educational expenses. She paid $ 2,000 for him on borrowed funds. These funds will be paid with a balloon payment at the end of 2009. Margarita is asking if she can take both the Hope credit and the Lifetime Learning Credits. Margarita will claim both credits if she can.

Margarita received tip income that she did not report because according to her employer she was not supposed to report tips for certain months that the amount did not reach a minimum reportable amount. Her employer included in Margarita's W-2 only tips that were more than the minimum amount to report. I asked Margarita to bring me just the totals of the tip income she received per month. The following list shows her tips received in their respective months.

Margarita will contribute the most that she can contributed to a traditional IRA on April 10, 2009 a few days before her return is due to be filed. She was not covered by a retirement plan at work.

111. Look at the Form 1040 you prepared for Margarita. What is the amount on Form 1040, Line 7?

A. $ 46,326.

B. $ 44,500.

C. $ 44,606.

D.

None of the above.

| Publication |

Page # |

Time |

112. Look at the Form 1040 you prepared for Margarita. What is the amount on Form 1040, Line 11?

A. $ 985.

B. $ 3,000.

C. $ -0-.

D.

None of the above.

| Publication |

Page # |

Time |

113. Look at the Form 1040 you prepared for Margarita. What is the amount on Form 1040, Line 19?

A. $ 985.

B. $ 911.

C. $ -0-.

D.

None of the above.

| Publication |

Page # |

Time |

114. Look at the Form 1040 you prepared for Margarita. What is the amount on Form 1040, Line 21?

A. $ 985.

B. $ 911.

C. $ -0-.

D.

None of the above.

| Publication |

Page # |

Time |

115. Look at the Form 1040 you prepared for Margarita. What is the amount on Form 1040, Line 22?

A. $ 46,326.

B. $ 44,500.

C. $ 49,916.

D.

None of the above.

| Publication |

Page # |

Time |

116. Look at the Form 1040 you prepared for Margarita. What is the amount on Form 1040, Line 32?

A. $ 5,000.

B. $ 4,000.

C. $ -0-.

D.

$ 3,000.

| Publication |

Page # |

Time |

117. Look at the Form 1040 you prepared for Margarita. What is the amount on Form 1040, Line 48?

A. $ 181.

B. $ 2,100.

C. $ 420.

D.

None of the above.

| Publication |

Page # |

Time |

118. Look at the Form 1040 you prepared for Margarita. What is the amount on Form 1040, Line 50?

A. $ 1,600.

B. $ 400.

C. $ 2,000.

D.

None of the above.

| Publication |

Page # |

Time |

119. Look at the Form 1040 you prepared for Margarita. What is the amount on Form 1040, Line 52?

A. $ 3,000.

B. $ 2,000.

C. $ 1,970.

D.

$ 846.

| Publication |

Page # |

Time |

120. Look at the Form 1040 you prepared for Margarita. What is the amount on Form 1040, Line 66?

A. $ 859.

B. $ 1,141.

C. $ 1,154.

D.

$ 4,928.

| Publication |

Page # |

Time |

121. Look at the Form 1040 you prepared for Margarita. What is the amount on Form 1040, Line 73a?

A. $ 3,400.

B. $ 1,811.

C. $ 2,670.

D.

$ 2,965.

| Publication |

Page # |

Time |

122. To claim the child tax credit, you can claim it on Form 1040EZ.

True False

| Publication |

Page # |

Time |

123. Your son turned 17 on December 31, 2008. You claim him as a dependent on your return. What is the amount of your child tax credit.

A. $ 1,000.

B. $ 2,000.

C. $ 3,000.

D. $

-0-.

| Publication |

Page # |

Time |

124. Credits, such as the child tax credit, the adoption credit, or the credit for child and dependent care expenses, are used to reduce tax. If your tax on Form 1040, line 46, or Form 1040A, line 28 is zero, figure the child tax credit to see if you qualify.

True False

| Publication |

Page # |

Time |

125. The additional child tax credit is a credit you may be able to take if you are not able to claim the full amount of the child tax credit.

True False

| Publication |

Page # |

Time |

126. This credit is called the "Earned Income Credit" because, to qualify, you must work and have earned income. Earned income includes

A. Certain dependent care benefits.

B. Certain adoption benefits.

C. Net earnings from self-employment or gross income received as a statutory

employee.

D.

All of the above.

| Publication |

Page # |

Time |

127. You can elect to include your non-taxable combat pay as earned income to figure the earned income credit.

True False

| Publication |

Page # |

Time |

128. For the Earned Income Credit, payments you received from a disability insurance policy that you paid the premiums for are earned income once you have reached minimum retirement age.

True False

| Publication |

Page # |

Time |

129. During the 2008 fall semester, Luis was a high school student who took classes on a half-time basis at Los Felix College. Luis was not enrolled as part of a college degree program at Los Felix College because this college only admits students to a degree program if the students have a high school diploma or equivalent. Luis

A. Did not have expenses that qualify him to figure a hope credit.

B. Was an eligible student for the hope credit for tax year 2008.

C. Was not an eligible student for the hope credit for tax year 2008.

D.

None of the above.

| Publication |

Page # |

Time |

130. Generally, you can claim an educational credit if you

A. Pay qualified education expenses of higher education.

B. Pay the education expenses for an eligible student.

C. Pay qualified education expenses for your spouse, or a dependent for whom you

claim an exemption on your return.

D.

All of the above.

| Publication |

Page # |

Time |

131. Include in your income on Form 1040, line 11, any alimony payments you received.

True False

| Publication |

Page # |

Time |

132. Report the value of any non-cash tips, such as tickets or passes, to your employer, because you have to pay social security and Medicare taxes or railroad retirement tax on these tips.

True False

| Publication |

Page # |

Time |

133. If you received $20 or more in cash and charge tips in a month from any one job and did not report all those tips to your employer, you must report the social security and Medicare taxes on the un-reported tips as additional tax on your return. To figure the additional taxes use

A. Form 8880.

B. Form W-2.

C. Form 4137.

D.

Form 8919.

| Publication |

Page # |

Time |

134. You can set up and make contributions to a traditional IRA if

A. You (or, if you file a joint return, your spouse) received taxable

compensation during the year.

B. You were not age 70 1/2 by the end of the year.

C. You have a job and your employer agrees to you making a contribution.

D.

Both A and B are correct.

| Publication |

Page # |

Time |

135. To claim the child tax credit your qualifying child must be

A. Under age 17 by the end of tax year 2008.

B. Your child, stepchild, grandchild, great-grandchild.

C. An eligible foster child that lived with you for more than half of 2008.

D. All of the above

| Publication |

Page # |

Time |

136. If the child tax credit exceeds the tax liability, part or all of the excess may be refundable as an additional credit calculated on Form 8812.

True False

| Publication |

Page # |

Time |

137. For purposes of the Child Tax Credit, your modified AGI is your AGI plus

A. Any amount excluded from income because of the exclusion of income from

Puerto Rico.

B. Any amount on line 45 or line 50 of Form 2555.

C. Any amount on line 18 of Form 2555-EZ or line 15 of Form 4563.

D. Any of the above

| Publication |

Page # |

Time |

138. For tax year 2008, how much Is the maximum child tax credit amount per qualifying child?

A. $600

B. $2,600

C. $1,000

D. $2,000

| Publication |

Page # |

Time |

139. Juanita Ramos is a single woman whom has three dependent children living with her. Her children are under 17. Juanita's total income is $25,000 as shown on her W-2. Her social security and Medicare taxes from Forms W-2, boxes 4 and 6 show $1,913 total withheld. Juanita provided her children total support and they lived with her all year. No one else can claim an exemption for Juanita or the children. Other than the Earned Income Credit, she had no other credits. Figure out what the Additional Child Tax Credit is for tax year 2008.

A. $ 303

B. $ 2,697

C. $ 2,475

D.

$ -0-

| Publication |

Page # |

Time |

140. Albert has one child who turned 17 years old on December 10, 2008. Albert's tax liability on Form 1040, line 46 is $1,100. What is Albert's Additional Child Tax Credit amount for 2008?

A. $ 1,000

B. $ 100

C. $ -0-

D.

None of the above.

| Publication |

Page # |

Time |

Please use California 540A/540 Booklet to do this assignment.

141. You paid $5,100 in child care, you are single and earned $28,000 for the entire year, and you have one qualifying child. What is your child and dependent care expenses credit for tax year 2008?

A. $840

B. $420

C. $1,428

D. $714

| Publication |

Page # |

Time |

142. I want to file my return and have no tax liability. If I claim the child and dependent care expenses credit, would I still get a refund for California based on my Child and dependent Care expenses credit?

A. Yes, tax liability can be zero, and you can still qualify because for California

credit is refundable

B. No, the amount of credit is limited to the amount of tax liability and is

non-refundable

C. No, even if you have tax, the child and dependent care credit would not cancel it and

thus there is no reason to claim it

D. No, California does not have a Child and Dependent Care Expenses Credit

| Publication |

Page # |

Time |

143. Juan and Maria Escobedo are married and keep up a home for their two pre-school children. In tax year 2008, they claimed their children as dependents. Juan earned $25,200 and Maria earned $8,200. They paid $5,900 in work related child care expenses. What is their credit?

A. $1,475

B. $737.50

C. $1,711

D. $738

| Publication |

Page # |

Time |

144. To claim the Child and Dependent Care Expenses Credit for California, you must complete and attach to your California tax return the following:

A. Federal Form 2441 or Schedule 2.

B. FTB Form 3506

C. Federal Form 3102 or Schedule 3

D. Federal Form 2106 or Schedule C

| Publication |

Page # |

Time |

145. In tax year 2008, if your gross income is $45,000 and your federal child and dependent care expenses credit amount was $480, then your California Credit is

A. $206

B. $-0-

C. $240

D. $163

| Publication |

Page # |

Time |

146. For Federal the child and dependent care expenses credit is a non-refundable credit and for California the credit is

A. Not allowed

B. Amount of credit if is always greater than Federal credit

C. The same as federal

D. A refundable credit

| Publication |

Page # |

Time |

147. What is the percentage of the federal Child and Dependent

Expenses Care credit that is allowed for California for taxpayers who earned

more than $100,000 in 2008?

A. 42%

B. 50%

C. 63%

D. 0%

| Publication |

Page # |

Time |

148. In tax year 2008, to qualify for the California child and dependent care expenses credit, your federal adjusted gross income must be less than

A. $40,000

B. $70,000

C. $100,000

D. $15,000

| Publication |

Page # |

Time |

149. In tax year 2008, if you are head of household and you would like to qualify for renter's credit, you would not qualify if your income is over what amount?

A. $34,936

B. $69,872

C. $66,544

D. $100,000

| Publication |

Page # |

Time |

150. If for more than half of the year, you lived in the home of a

parent, foster parent, or legal guardian in 2008 whom can claim you as a

dependent

A. You do not qualify for the renter's credit.

B. You prepare a renter's qualification record and divide

the credit accordingly.

C. You qualify to claim the credit because everyone in the household

qualifies as long as you pay at least $1.00 of rent.

D. Since you are a dependent, you still qualify for $30 of renter's credit.

| Publication |

Page # |

Time |

151. The non-refundable renter's credit qualification record must be kept with your records; therefore, you should not mail it.

True False

| Publication |

Page # |

Time |

152. To qualify for Renter's credit, you must have paid rent for at least 6 months of the tax year and your principal residence must have been in California.

True False

| Publication |

Page # |

Time |

153. If your filing status was married filing separate, you cannot claim the California renter's credit.

True False

| Publication |

Page # |

Time |

154. If a single employer withheld California State Disability Insurance (SDI) from your wages at more than 0.8% of your gross wages,

A. Contact the employer for refund

B. Claim excess SDI on your Form 540/540A

C. Contact the state of California for a refund

D. You cannot get a refund because once W2 is filed it is too late.

| Publication |

Page # |

Time |

155. You may be entitled to claim a credit for excess SDI on Form 540/540A if

A. You had two or more employers during 2008.

B. You received more than $86,698 in wages

C. The amounts of SDI withheld appear on your forms W2.

D. All of the above

| Publication |

Page # |

Time |

156. For California you claim the child and dependent care expenses credit on form

A. FTB 3506

B. FTB 3808

C. FTB 2441

D. FTB 2

| Publication |

Page # |

Time |

157. For purposes of claiming the California Child and Dependent Care Expenses Credit, if your child turns age 13 during the year

A. The child is not a qualifying person because he has to have been under age 13

at the end of the year.

B. The child's age does not matter as long as he is your dependent.

C. The child is a qualifying person for the part of the year he or she was under

12 years old.

D. The child is not a qualifying child because the child has to be in pre-school.

| Publication |

Page # |

Time |

158. In tax year 2008, my wife did not work all year because she was not able to care for herself for the entire year. I worked and earned $21,000. We have one qualifying child for the Child and Dependent care credit. We paid $2,000 for child care. How much credit can we qualify for?

A. $620

B. $310

C. $1,000

D. $744

| Publication |

Page # |

Time |

159. You are single and only paid rent for one month in 2008. You qualify to claim the renter's credit.

True False

| Publication |

Page # |

Time |

160. If there are no differences between your federal and California income or deductions, do not file a Schedule CA(540).

True False

| Publication |

Page # |

Time |

161. What are the 2008 exemption amounts for California?

A. Personal $99.

B. Dependent $309.

C. Personal $3,692.

D. Both A and B are correct.

| Publication |

Page # |

Time |

162. Who is a qualifying individual for the Child and Dependent Care Credit?

A. A dependent of the taxpayer under 13 years of age

B. A dependent of the taxpayer who is physically or mentally unable to care for

him or herself.

C. Spouse of the taxpayer who is physically or mentally unable to care for him

or herself.

D. Any of the above

| Publication |

Page # |

Time |

163. One of the requirements to qualify to claim the Child and Dependent Care Credit for California is that

A. You paid for care so you (and your spouse/RDP) could work or look for work.

B. Your qualifying child is over 13 years of age just as long as he or she is

not over 19.

C. Your adjusted gross income must be more than $100,000 for 2008.

D.

You have no earned income for 2008.

| Publication |

Page # |

Time |

164. If military personnel are not legal residents of California they do not qualify for the renter's credit.

True False

| Publication |

Page # |

Time |

165. You qualify for the Nonrefundable Renter's Credit if you rented a property for more than half the year that was exempt from California property tax in 2008.

True False

| Publication |

Page # |

Time |

166. Laura was 17 years of age in 2008. She lived with her parents and under their care in 2008. Laura can claim the Nonrefundable Renter's Credit for 2008.

True False

| Publication |

Page # |

Time |

167. You may be entitled to claim a credit for excess SDI (or VPDI) only if

A. You had two or more employers during 2008.

B. You received more than $86,698 in wages.

C. The amounts of SDI (or VPDI) withheld appear on your Forms W-2.

D. All of the above.

| Publication |

Page # |

Time |

168. The 2008 SDI (or VPDI) limit is

A. $100,000

B.

$693.58

C.

$86,698

D. 0.8%

| Publication |

Page # |

Time |

169. The Nonrefundable Renter's Credit is $60 for individual taxpayers a (single or married filing a separate return) with an adjusted gross income of $34,936.00 or less and $120 for married couples (married filing jointly, head of household, or qualified widow (er)) with an adjusted gross income of $69,872.00 or less.

True False

| Publication |

Page # |

Time |

170. Attach a doctor's statement to the back of Form 540/540A indicating your or your spouse/RDP are visually impaired every time you file a tax return to claim the blind exemption credit.

True False

| Publication |

Page # |

Time |

171. If you had no federal filing requirement, use the same filing status for California you would have used to file a federal income tax return. RDPs who file single for federal must file

A. Married/RDP filing jointly for California.

B. Married/RDP filing

separately for California.

C. Single for

California.

D. Both A and B are

correct.

| Publication |

Page # |

Time |

172. To claim an exemption credit for each of your dependents, enter each dependent's name and relationship to you in the space provided. If there is not enough space

A. You don't need to name your dependents, just multiply the number of dependent

exemptions.

B. Only

include dependents that fit in the space provided.

C. Attach a separate sheet of paper to include all dependents.

D. None of

the above.

| Publication |

Page # |

Time |

173. For your California return you need to adjust your federal itemized miscellaneous deductions if you had

A. Gambling losses

B. Medical

and Dental Expenses

C. Mortgage

Interest Expenses

D. Contributions

to Church

| Publication |

Page # |

Time |

174. For your California return, you may need to adjust your itemized miscellaneous deductions if you have

A.

A federal Mortgage Interest Credit

B.

An investment interest expense deduction

C. Employee

Business Expenses

D. Any of the above

| Publication |

Page # |

Time |

175. California partially conforms to the Federal Mortgage Forgiveness Debt Relief Act of 2007 (P.L. 110-142) for the 2007 and 2008 tax years. California limits the amount of qualified principal residence indebtedness to

A. $800,000

($400,000 Married/RDP filing separately).

B. $2,000,000

($1,000,000 Married/RDP filing separately).

C. $250,000

($125,000 Married/RDP filing separately).

D. $100,000

($50,000 Married/RDP filing separately).

| Publication |

Page # |

Time |

176. Servicemembers domiciled outside of California, and their spouses/RDPs, may exclude the servicemember's military compensation from gross income when computing the tax rate on nonmilitary income.

True False

| Publication |

Page # |

Time |

177. The amount you can claim as a deduction for exemptions is phased out once your adjusted gross income (AGI) goes above a certain level for your filing status. For example, Esteban is a single man, age 39, who has two dependents. His dependents don't qualify him for the head of household filing status. George's adjusted gross income is $167,000 for tax year 2008. What is the amount Esteban will enter on form 540/540A, line 21 as a deduction for his exemptions?

A.

$ 717.

B.

$ 10,303.

C.

$ 681.

D. $ 1,275.

| Publication |

Page # |

Time |

178. The amount you can claim as a deduction for exemptions is phased out once your adjusted gross income (AGI) goes above a certain level for your filing status. For example, Cecilia is a single woman, age 32, who has three dependents. Her dependents don't qualify her for the head of household filing status. Cecilia's adjusted gross income is $182,000 for tax year 2008. What is the amount Cecilia will enter on form 540/540A, line 21 as a deduction for her exemptions?

A.

$ 927.

B.

$ 834.

C.

$ 1,026.

D. $ -0-.

| Publication |

Page # |

Time |

179. Treat a prior unsuccessful attempt to adopt a child (even when the costs were incurred in a prior year) an a later successful adoption of a different child as one effort when computing the cost of adopting the child. Include the following cost if directly related to the adoption process:

A.

Fees for Department of Social Services or a licensed adoption

agency.

B.

Medical expenses not reimbursed by insurance.

C.

Travel expenses for the adoptive family.

D. Any of the above.

| Publication |

Page # |

Time |

180. You may NOT claim the credit for Dependent Parent if you used the single, head of household, qualifying widow(er), or married/RDP filing jointly filing status. You can claim this credit only if

A.

You were married/ or an RDP at the end of 2008 and you used the

married/RDP filing separately filing status.

B.

Your spouse/RDP was not a member of your household during the

last six months of the year.

C.

You furnished over one-half the household expenses for your

dependent mother's or father's home, whether or not she or he lived in your

home.

D. All of the above.

| Publication |

Page # |

Time |

In this tax school part, you will be able to apply tax knowledge you have for California and review the new information for the year.

Use publication FTB 540/540A Booklet to complete this topic.

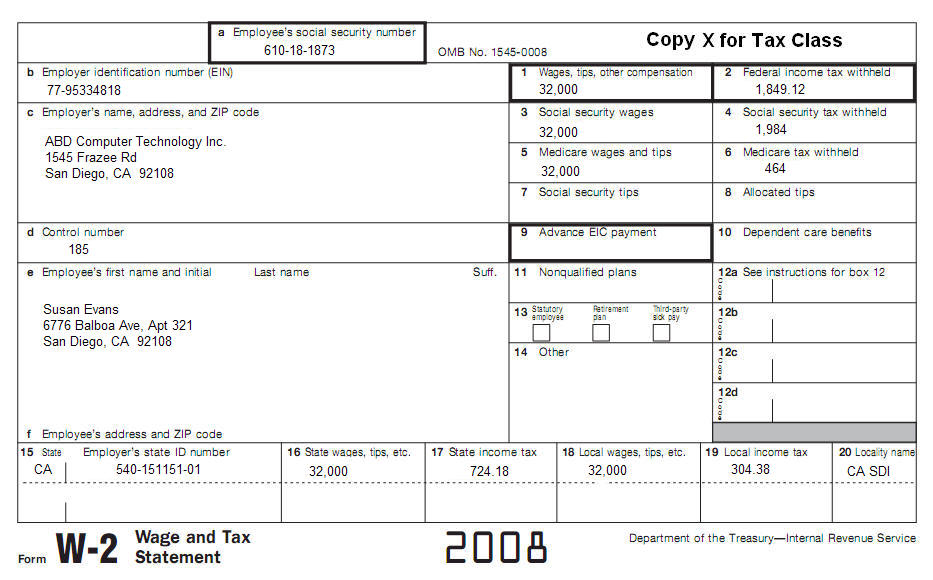

Prepare the appropriate California tax forms for Susan Evans. Her address is current on Form W-2. Get all her basic information from the following W2, including income information.

Susan Evans (DOB 03/04/1955) is a single woman. For tax year 2008 she received the following:

| California state refund $180.00 (Susan did not itemized in 2007). | |

| Unemployment Compensation $ 673 |

Susan Evans is divorced and has two children:

| Laura Franchot, DOB May 10, 1994 (SSN 620-16-6515) | |

| Sean Franchot, DOB February 5, 1999 (SSN 610-76-1554) |

Her children lived with her all of 2008 and she is the only person that can claim her children.

Susan paid $13,200 rent for tax year 2008.

Susan noticed that too much money was withheld for California SDI on her W-2.

A neighbor cares for Susan's younger child (Sean) after school, on holidays, and during the Summer while Susan is at work. Susan pays her neighbor Consuelo Echeverria (SSN 612-34-3453) $2,900 for this care. Her address is 3424 Cesar Chavez Ave, San Diego, CA 92108.

181. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 13?

A. $ 32,000.

B. $ 32,673.

C. $ 24,616.

D. $ -0-.

| Publication |

Page # |

Time |

182. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 14a?

A. $ 430.

B. $ -0-.

C. $ 673.

D. $ 180.

| Publication |

Page # |

Time |

183. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 14b?

A. $ 32,000

B. $ -0-

C. $ 673

D. None of the above

| Publication |

Page # |

Time |

184. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 14g?

A. $ 180.

B. $ 673

C. $ 343

D. None of the above

| Publication |

Page # |

Time |

185. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 18?

A. $ 309

B. $ 3,692

C. $ 7,384

D. $ 24,616

| Publication |

Page # |

Time |

186. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 20?

A. $ 24,616

B. $ 717

C. $ 837

D. $ 349

| Publication |

Page # |

Time |

187. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 21?

A. $ 120

B. $ 717

C. $ 349

D. $ 837

| Publication |

Page # |

Time |

188. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 28?

A. $ -0-

B. $ 60

C. $ 120

D. None of the above

| Publication |

Page # |

Time |

189. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 29?

A. $ 837

B. $ 488

C. $ 120

D. $ 717

| Publication |

Page # |

Time |

190. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 39?

A. $ -0-

B. $ 48

C. $ 377

D. $ 1,101

| Publication |

Page # |

Time |

191. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 66?

A. $ 1,167

B. $ 1,101

C. $ 1,149

D. None of the above

| Publication |

Page # |

Time |

192. Unemployment compensation is non-taxable for California.

True False

| Publication |

Page # |

Time |

193. For the child and dependent care expenses credit, the following is true regarding claiming the credit for California.

A. California allows this credit only for care provided in California.

B. An RDP may file a joint California return and claim this credit.

C. The California child and dependent care expenses credit is a percentage of

the federal credit.

D. All of the above.

| Publication |

Page # |

Time |

194. California includes California lottery winnings in taxable income.

True False

| Publication |

Page # |

Time |

195. For California, you may be able to file as head of household if your child lived with you and you lived with your spouse/RDP during the entire last six months of 2008.

True False

| Publication |

Page # |

Time |

196. Use the same filing status for California that you used for your federal income tax return, unless you

A.

Itemize your deductions.

B. Meet the requirements to be considered unmarried.

C.

Are an a same-sex married individual or an RDP.

D. Are a nonresident for the entire year and had income from California Sources

during 2008.

| Publication |

Page # |

Time |

197. Beginning in 2005 (conformity with Federal), for a child to qualify as your foster child for head of household purpose, the child must

A.

Be placed with you by an authorized placement agency.

B.

Be placed with you by an order of a court.

C.

Have lived with you all year to be your qualifying child.

D. Both A and B are correct.

| Publication |

Page # |

Time |

198. You must use the same filing status for California that you used for your federal income tax return unless in cases when a spouse is a member of the Armed forces or a nonresident for the entire year and no income from California source. According to federal law, if you are living together in a common law marriage that is recognized in the state where you now live or in the state where the common law marriage began you are considered married for tax purposes. You are considered married for California purposes if

A.

You were married as of December 31, 2008, even if you did not live with your

spouse/RDP at the end of 2008.

B. Your spouse/RDP died in 2008 and you did not remarry in 2008.

C.

You spouse/RDP died in 2009 before you file a 2008 return.

D. Any of the above.

| Publication |

Page # |

Time |

199. You normally must use the same filing status for California that you used for your federal income tax return. However, if you filed a joint return for federal you may file separately if either spouse was:

A.

An active member of the United State armed forces or any auxiliary military

branch during 2008.

B.

Was in the process of filing for divorce.

C.

Unable to be found and you had good reason to believe she was deceased.

D. All

of the above.

| Publication |

Page # |

Time |

200. If you file a joint return for federal, you may file separately for California if either spouse was a nonresident for the entire year and had no income from California sources during 2008. However, if the spouse earning the California source income is domiciled in a community property state, community income will be split equally between the spouses. Therefore, they will not qualify for the nonresident spouse exception because

A.

Both spouses were domiciled outside of California.

B.

Both spouses are considered to not have California taxable income.

C.

Both spouses will have California source income.

D. You have a federal requirement to use the same filing status for California

that you do for Federal.

| Publication |

Page # |

Time |

![]()