|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Back to Tax School Homepage | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Tax Topic 30 - Moving Expenses

In this tax topic you will the learn how to take a deduction for certain expenses of moving to a new home because of a change in job location or starting a new job. You will become aware of what moving expenses are deductible and not deductible, who can take the moving expense deduction, when and where to report the expenses and how reimbursements affect your moving expenses deduction. Moving expense deductions can be deducted by either employees or self employed taxpayers.Student Instructions:Print this page, work on the questions and then submit test by mailing the answer sheet or by completing quiz online. Instructions to submit quiz online successfully: Step-by-Step check list Answer Sheet Quiz Online Most forms are in Adobe Acrobat PDF format.

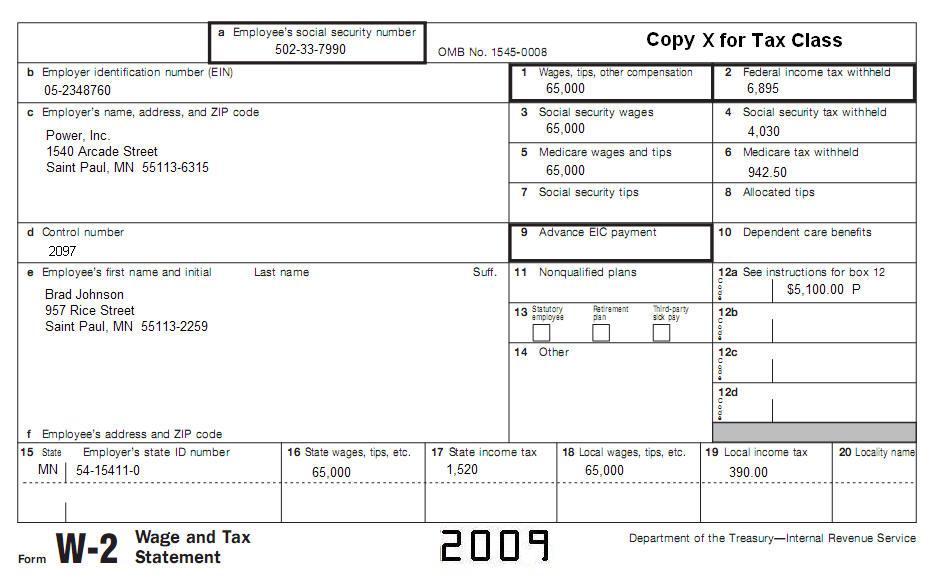

Material needed to complete this assignment:Use IRS Publication 521 to complete this topic. Prepare Form 1040, Form 3903. Brad Johnson is married and has no children. He owned his home in Florida where he worked. On December 8, 2008, his employer told him that he would be transferred to Saint Paul as of January 20, 2009. His wife, Samantha (SSN 610-25-3940), flew to Saint Paul on January 2008 to look for a new home. She put a down payment of $25,000 on a house being built and came back to Florida on January 8, 2009. The Johnsons sold their Florida home for $1,500 less than they paid for it. The home was free and clear by the time the construction was completed. They contracted to have their personal effects moved to Saint Paul on January 15, 2009. The family arrived in Saint Paul January 18, 2009 only to find out that their new home was not yet completed. They stayed in a nearby motel awaiting completion of the house until February 12, 2009. On January 20, 2009, Brad went to work in the Saint Paul plant where he works to the present time. Their records for the move show:

The employer included this reimbursement on Brad's Form W-2 for the year. The reimbursement of deductible expenses, $5,100 for moving household goods and travel to Saint Paul, was included in Box 12 of Form W-2. His employer identified this amount with code P. The employer included the balance, $649 reimbursement of nondeductible expenses, in box 1 of W-2 with Brad's other wages. The employer withholds taxes from the $649 which is also included in W-2.

Pat moved to start a new job and met the distance and time tests. What are the total moving expenses that can be deducted?

A. $2,150. 10. Excess reimbursement includes any amount for which you did not adequately account to your employer within a reasonable period of time. Any excess reimbursement for you moving expenses must be returned to the person paying the reimbursement. You adequately account by

A. Giving your employer documentary evidence of your moving expenses.

11. You can generally consider moving expenses incurred within 1 year from the date you first reported to work at the new location as closely related to in time to the start of work. If you do not move within 1 year of the date you begin work, you

A. Can file an extension to be able to claim the moving expenses. 12. You can deduct moving expenses for a move to a new home in the United States when you permanently retire. You are considered permanently retired when you cease gainful full-time employment or self-employment. If, at the time you retire, you intend your retirement to be permanent, you

A. Will not be able to claim moving expenses unless you can prove

retirement will be permanent. 13. If you deduct moving expenses but do not meet the time test in 2010 or 2011, you must

A. Report your moving expense deduction as other income on your Form

1040 for the year you cannot meet the test. 14. A move begins when

A. You contract for your household goods and personal effects to be

moved to your home in the United States, but only if the move is

completed within a reasonable time. 15. If you are living in the United State, retire, and then move and remain retired, you can claim a moving expense deduction for that move. True False 16. Roxana's employer transferred her from Boston, Massachusetts, to Buffalo, New York. On her way to Buffalo, Roxana drove into Canada to visit the Toronto Zoo. As a result

A. The expenses paid or incurred for the excursion are deductible. 17. If you use your car to take yourself, members of your household, or your personal effects to your new home, you can figure your expenses by deducting

A. You actual expenses, such as gas and oil for your car, if you keep

an accurate record of each expense. 18. Patrick Lopez is a resident of North Carolina and has been working there for the last 4 years. Because of the small size of his apartment, he stored some of his furniture in Georgia with his parents. Patrick got a job in Washington D.C. It cost him $1,200 to move his furniture from N.C. to D.C. and $4,000 to move his furniture to Georgia from North Carolina (his former home), it would have cost him $1,500 to move his stored furniture from N.C. to Washington. Moving expense amount he can deduct is

A. $2,700. 19. Use Form 3903 to figure your moving expense deduction. Use a separate Form 3903 for each move for which you are deducting expenses. You do not have to complete Form 3903 if

A. You moved to a location outside the United States in an earlier

year. 20. If you are claiming only storage fees while you are away from the United States as a moving expense deduction

A. Enter the storage fees on line 1 of Form 3903. 21. Enter on line 4 of Form 3903 the total amount of your moving expense reimbursement that was excluded from your wages. If the moving expenses are less than reimbursement,

A. Include it as income on Form 1040, line 7. 22. Sonia's pre-move house-hunting trip includes:

The amount that Sonia can deduct for moving expenses is

A. $600. 23. If you are a member of the Armed Forces on active duty and you move because of a permanent change of station, you do not have to meet the distance and time tests. You can deduct your un-reimbursed moving expenses. A permanent change of station is

A. A move from your home to your first post of active duty. 24. To get you to work in another city, your new employer reimburses you under an accountable plan for the $6,500 loss on the sale of your home. You

A. Are reimbursed under an accountable plan so nothing needs to be

done. 25. You lived in Boston an accepted a job in Atlanta. Under an accountable plan, your employer reimbursed you for your actual traveling expenses from Boston to Atlanta and the cost of moving your furniture to Atlanta. Your employer will include the re-imbursement in

A. Box 1 of your Form W-2. 26. You can include the cost of storing and insuring household goods and personal effects within any period of _____ after the day your things are moved form your former home and before they are delivered to your new home.

A. 30 consecutive days. 27. If you claim the foreign earned income or foreign housing exclusion, you cannot deduct the part of your moving expenses that relates to the excluded income. True False 28. To be an accountable plan, your employer's reimbursement arrangement must require that

A. Your expenses must have a business connection. 29. You can deduct your moving expenses (for the same expenses) on both Form 3903 and Schedule A and thus get a higher deduction. True False 30. What constitutes a "reasonable period of time" depends on the facts and circumstances of your situation. The following action will be treated as taking place within a reasonable period of time.

A. You receive an advance within 30 days of the time you have an

expense.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Back to Tax School Homepage |