|

|

| Back to Tax School Homepage |

|

Tax Topic 14 - Tax Provisions for the Elderly and the Disabled

In this tax topic you will learn how you may be able to reduce the tax owed by taking the credit for the elderly or the the disabled. Additionally, you will learn who qualifies to take the credit for the elderly and and how to figure the credit. Individuals who are able to take the credit for the elderly or the disabled are usually individuals who are are age 65 or older, or are individuals who are retired on permanent and total disability and have taxable disability income. Student Instructions:Print this page, work on the questions and then submit test by mailing the answer sheet or by completing quiz online. Instructions to submit quiz online successfully: Step-by-Step check list Answer Sheet Quiz Online

Most forms are in Adobe Acrobat PDF format.

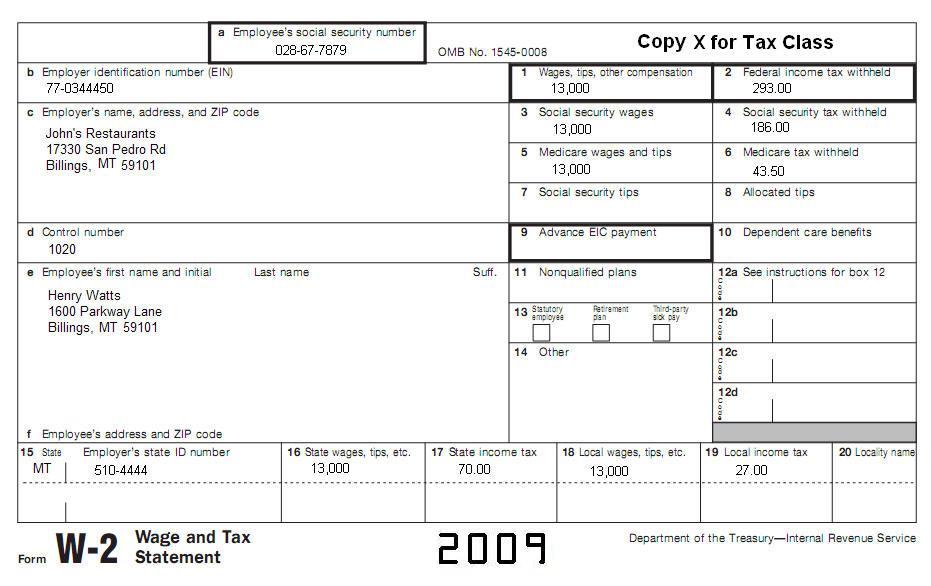

Use IRS Publication 524 and IRS Publication 554 (also IRS 1040A Instructions) to complete this topic. Prepare a Federal Form 1040A and Schedule R for Henry Watts. Get all basic information from W2, including income information. Address information on W2 is current. Mr. Watson's date of birth is April 6, 1942.

|

| Back to Tax School Homepage |