|

|

|

Topic 26 - Tax Withholding and Estimated Tax

|

|

Our federal income tax system is a pay-as-you-go tax. You must

pay the tax as you receive the income during the year. In this tax topic you

will learn how taxpayers get income withheld from their pay and other income

such as pensions, bonuses, commissions, and gambling winnings. However, if no

one withholds from your sources of income, you might have to pay estimated taxes

such as when the taxpayer is business for himself or herself. A taxpayer may

also have to pay estimated taxes on income such as dividends, interest, capital

gains, rents, and royalties. In addition, you will learn how to take credit for

the withholding on the tax return and calculate the penalties for not paying

enough.

Tax School Homepage Student Instructions: Print this page, work on the questions and then submit test by mailing the answer sheet or by completing quiz online. Instructions to submit quiz online successfully: Step-by-Step check list Answer Sheet Quiz Online

Most forms are in Adobe Acrobat PDF format.

Please use

IRS

Publication 505 to complete this topic.

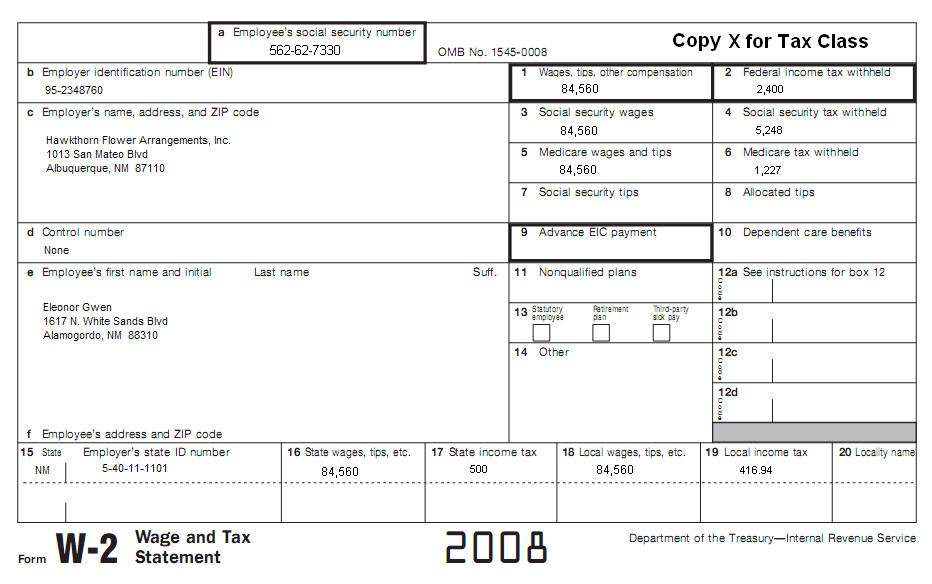

Prepare Form 1040

and

Form 2210 for Eleonor

Gwen. She is single and has no dependents. In tax year 2007 Eleonor did not have a tax liability. For 2008, Eleonor worries that she may owe a penalty for

underpayment of her tax.

|

| Back to Tax School Homepage |