|

|

||||||||||||

|

Topic 16 - Higher Education Tax Credits, Scholarships and Fellowships

|

||||||||||||

In this tax topic you will learn the the different tax treatment of various types of educational assistance, and the tax benefits that may be available to you if you are saving for or paying education costs for yourself or other students in your immediate family. In addition, you will also learn how and when to you can take business deductions for work-related education and the educational tax credits available to your for higher education.Tax School Homepage Student Instructions: Print this page, work on the questions and then submit test by mailing the answer sheet or by completing quiz online. Instructions to submit quiz online successfully: Step-by-Step check list Answer Sheet Quiz Online

Most forms are in Adobe Acrobat PDF format.

Use IRS Publication 970 to answer the following questions. Complete Form 1040, Form 8863 for this topic. Maria's family goes to school.

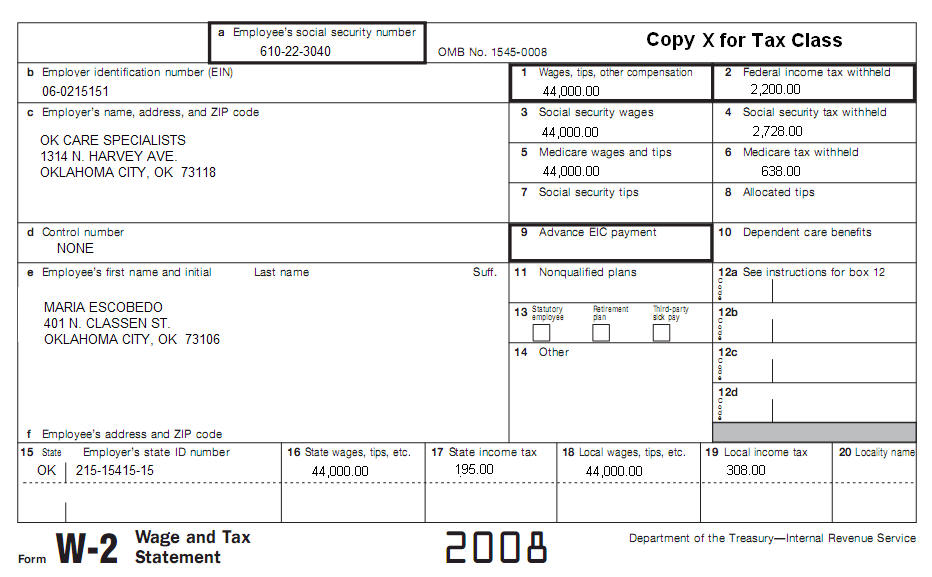

Maria is a not married. She provides a home for her son and daughter. She is the only one that can claim them. Maria provided for her family by herself. No one can claim her or her children as dependents. She paid rent all year for a of $9,600.00. Maria received a tax-free scholarship from Women for Education Inc. The amount she received was $3,000 towards her studies to get a nursing degree at the same community college her kids attend. All the money was for enrollment and attendance as specified by the school. Get all basic information from the following W2, including income information.

|

||||||||||||

| Back to Tax School Homepage |