|

|

||||||||

| Back to Tax School Homepage | ||||||||

|

Tax Topic 8 - Charitable Contributions

In topic reviews which organizations are qualified to receive deductible charitable contributions, the types of contributions that can be deducted, how much can be deducted and which records to keep. A charitable contribution is a donation or gift to, or for the use of, a qualified organization and it is voluntary without expecting anything in return.Tax School Homepage Student Instructions: Print this page, work on the questions and then submit test by mailing the answer sheet or by completing quiz online. Instructions to submit quiz online successfully: Step-by-Step check list Answer Sheet Quiz Online

Most forms are in Adobe Acrobat PDF format.

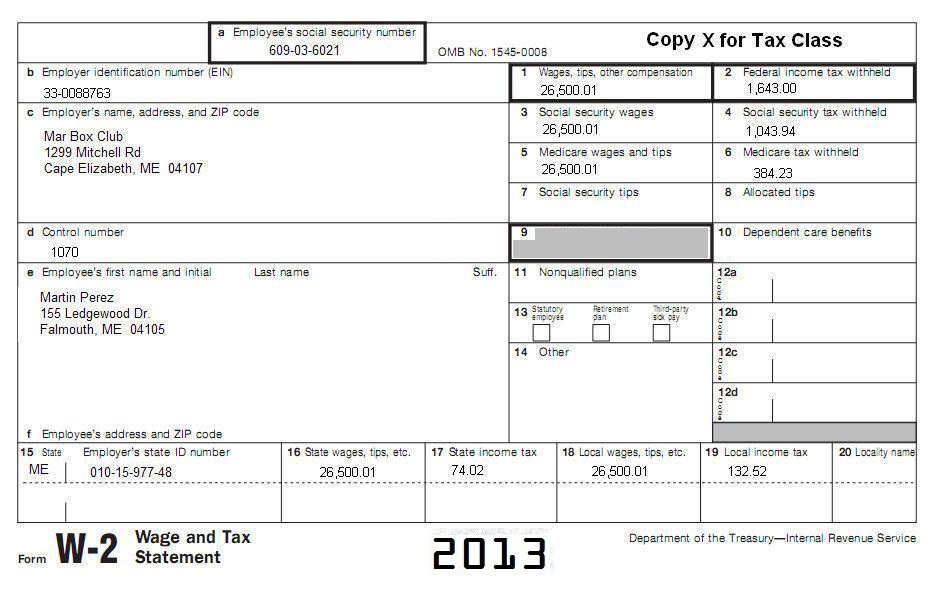

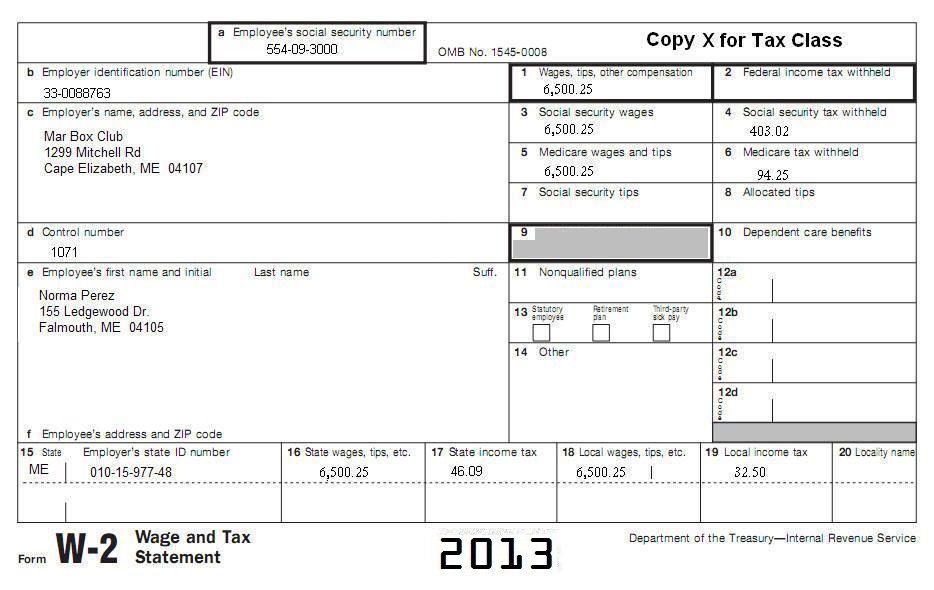

Use IRS Publication 526, IRS Publication 561, and Form 1040 Instructions (Form 1040 instructions only up to page 98) and Schedule A (1040) instructions to complete this tax topic. Please note: Form 1040 Instructions (Form 1040 instructions only up to page 98) will be used for the rest of the topics in the initial tax preparer certification course. You will be responsible to answer questions from the Form 1040 instructions booklet (up to page 98) on every topic so read it carefully. Tax Return Situation 1: Complete a Schedule A for Martin Perez (699-03-6021) and Norma Perez (554-09-3000. Use the W2's and information for this topic. Martin claims his parents on his return. Paul Perez (SSN 580-16-6733). Lucy Perez (SSN 580-16-7683) . They had the following expenses for the 2013 tax year:

November 15, 2013, they donated the following items to Goodwill (1849 Stillwater Ave, Bangor, ME 04401):

On November 10, 2013, Martin gave blood to Jean Denys to treat a severe anemia caused by a blood disease. Mr. and Mrs. Denys offered Martin $1,600 for the favor as their finding of a donor was very unlikely and they felt very lucky that they found Martin. Martin refused the money saying that it was a contribution he was making to them. Mr. and Mrs. Denys' address is 10 Gary Maitta Parkway, South Portland, ME 04106. On December 12, 2013, Norma and Martin donated $1,500 in cash to the Mexican Red Cross: +Cruz Roja Mexicana, Juan Luis Vives #200. Col. Los Morales Polanco, 11510 México D.F. Complete Form 8283 for the Non-cash Charitable Contributions. You may need General sales tax information from instructions for Schedule A&B (Form 1040). After you have completed Schedule A prepare a Federal Form 1040. Use the Schedule A that you filled out to complete the return. Get all other their basic information from the following W2, including income and address information.

|

||||||||

| Back to Tax School Homepage |