|

|

||||||||||||||||

| Back to Tax School Homepage | ||||||||||||||||

|

Tax Topic 19 - Selling Your Property

In this topic your will become familiar with the rules that apply when you sell your main home. Your main home is the home lived in most of the time. You will learn the amount that you can exclude from income of the gain from the sale of your home. In addition, you will learn what to do when the sale cannot be excluded from income, in which case it becomes fully taxable. You will also learn what to do with a non-deductible loss of the sale of your home. Tax School Homepage Student Instructions: Print this page, work on the questions and then submit test by mailing the answer sheet or by completing quiz online. Instructions to submit quiz online successfully: Step-by-Step check list Answer Sheet Quiz Online Most forms are in Adobe Acrobat PDF format.

Material needed to complete the sections in this assignment:Use IRS Publication 523, IRS Publication 544, IRS Publication 537, IRS Publication 551, and Form 1040 Instructions (Form 1040 instructions only up to page 98) to complete this tax topic. Please note: Form 1040 Instructions (Form 1040 instructions only up to page 98) will be used for the rest of the topics in the initial tax preparer certification course. You will be responsible to answer questions from the Form 1040 instructions booklet (up to page 98) on every topic so read it carefully.

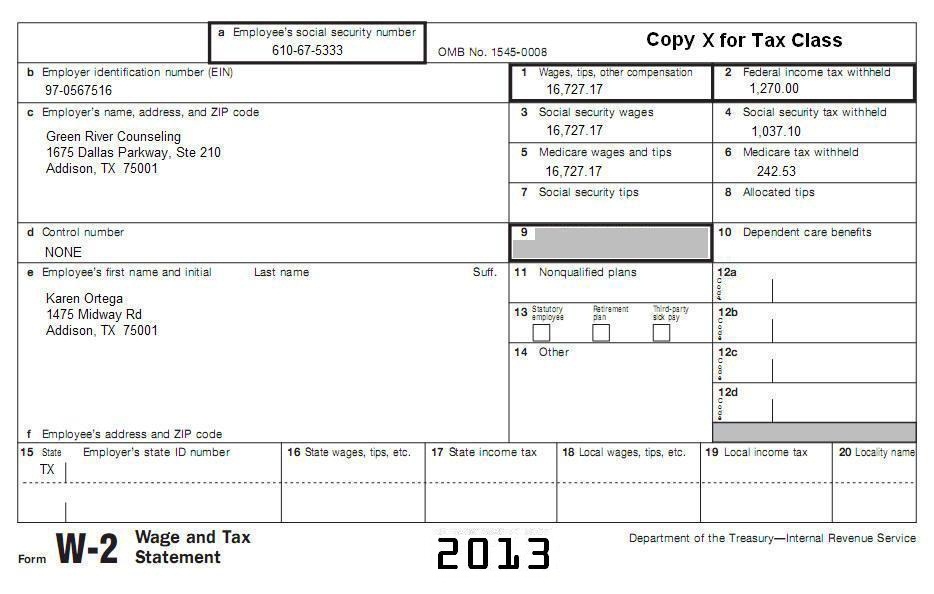

Karen's W-2 shows her current address information.

1. Look at the Form 1040 you prepared for Karen Ortega. What is the amount on Form 1040, Line 13?

A. $9,727.

2. Look at the Form 1040 you prepared for Karen Ortega. What is the amount on Form 1040, Line 22?

A. $16,727.

|

||||||||||||||||

| Back to Tax School Homepage |