|

|

||||||||||||||||||||||

| Back to Tax School Homepage | ||||||||||||||||||||||

|

Tax Topic 18 - Rental Income and Expenses

In this tax topic you will learn how to report rental income and expenses on tax returns, the expenses you are allowed to deduct. Amongst the items you will become aware of here, are the rental-for-profit activities in which there is no personal use of the property. In addition, you will learn about taking depreciation as it applies to rentals and how to claim the correct amount. Finally, you will also become aware of the rules for rental income and expenses when there is also personal use of the property, such as with vacation homes. Tax School Homepage Student Instructions: Print this page, work on the questions and then submit test by mailing the answer sheet or by completing quiz online. Instructions to submit quiz online successfully: Step-by-Step check list Answer Sheet Quiz Online Most forms are in Adobe Acrobat PDF format.

Material needed to complete the sections in this assignment:Use IRS Publication 527, Schedule A instructions, Schedule E instructions and Form 1040 Instructions (Form 1040 instructions only up to page 98) to complete this tax topic. Please note: Form 1040 Instructions (Form 1040 instructions only up to page 98) will be used for the rest of the topics in the initial tax preparer certification course. You will be responsible to answer questions from the Form 1040 instructions booklet (up to page 98) on every topic so read it carefully. Tax Return Situation 1: Prepare Form 1040, Form 4562, Schedule A, Schedule E. Teresa is single and has no children. In August, 2013, Teresa moved in with her mother to keep her company. Instead of selling the condo she had been living in, she decided to convert it to rental property. Teresa selected her tenant and started renting the condo on September 1st. Teresa charges $800 per month for rent and collects it herself. Teresa received an $800 security deposit and $800 last months rent from her tenant. She plans to return the security deposit to her tenant at the end of the lease but not until doing an inspection on the condition of the condo. She actively participated in the rental activities. She had advertised and rented the condo to the current tenant herself. She also collected the rents. All repairs were contracted by Teresa. Her condo expenses for the 2013 tax year are:

Teresa bought this property in 1987 for $35,000. Her property tax was based on assessed values of $10,000 for the land and $25,000 for the condo. Before changing it to rental property, Teresa had the following work done to the condo:

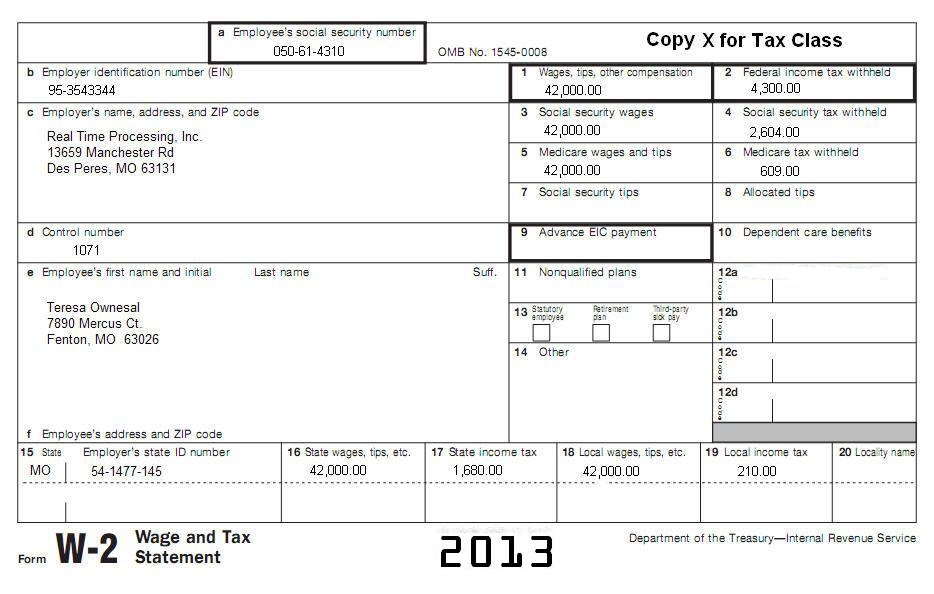

On September 1, 2013, when Teresa changed her 1 bedroom condo to rental property, the property had a fair market value of $92,000 ($20,000 land and $72,000 building). Property is located at 6109 Sunnyslope Drive, Kansas City, Missouri, 64134. All her information on the W-2 is current, including address information.

|

||||||||||||||||||||||

| Back to Tax School Homepage |