|

|

||||||||||||||||

| Back to Tax School Homepage | ||||||||||||||||

|

Tax Topic 11 - Child and Dependent Care Expenses Credit

You will become aware of the tests you must meet to claim the credit, how to figure and claim the credit. You may be able to claim the credit if you pay someone to care for your dependent who is under age 13 or for your spouse or dependent who is not able to care for himself or herself.Tax School Homepage Student Instructions: Print this page, work on the questions and then submit test by mailing the answer sheet or by completing quiz online. Instructions to submit quiz online successfully: Step-by-Step check list Answer Sheet Quiz Online

Most forms are in Adobe Acrobat PDF format.

Use IRS Publication 503, and Form 1040 Instructions (Form 1040 instructions only up to page 98) to complete this tax topic. Please note: Form 1040 Instructions (Form 1040 instructions only up to page 98) will be used for the rest of the topics in the initial tax preparer certification course. You will be responsible to answer questions from the Form 1040 instructions booklet (up to page 98) on every topic so read it carefully.

Only Lawrence worked. Theresa did not work. Theresa attended school full time for 7 months in 2013. The school was not an on-the-job training course, correspondence school, or internet school. When she was in school they were taken care of by Happy Child, inc.:

Also figure the Child tax credit and enter on Form 1040A. In addition to their earnings, they had the following:

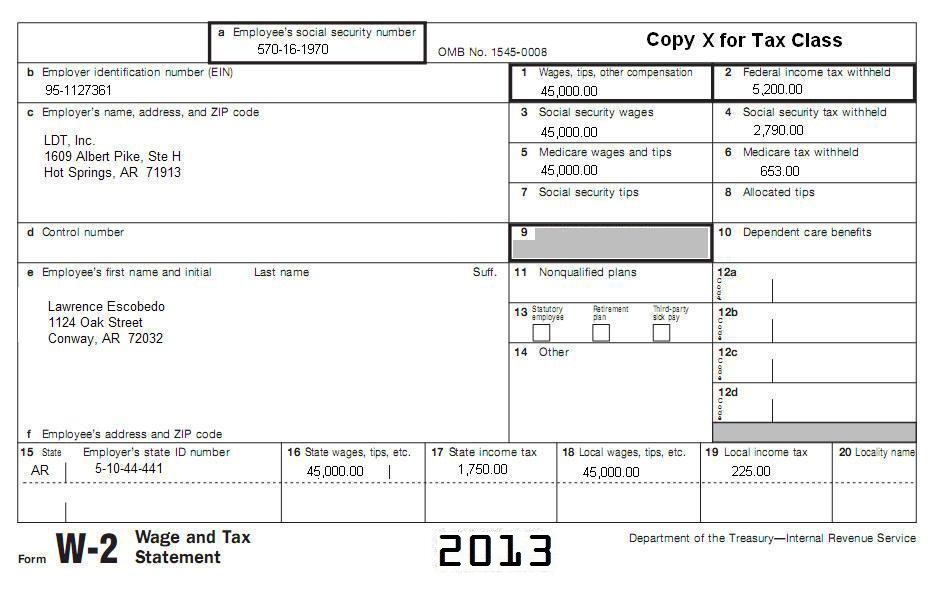

Complete Form 1040A, Form 2441, Form 8812 and Schedule EIC. You will also need 2013 tax tables. Use the following attached W2. All information on W2 is current.

1. Look at the Form 1040A you prepared for Lawrence and Theresa. What is the amount on Form 1040A, Line 28?

A.

$2,026.

2. Look at the Form 1040A you prepared for Lawrence and Theresa. What is the amount on Form 1040A, Line 29?

A. $0.

|

||||||||||||||||

| Back to Tax School Homepage |