|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Back to Tax School Homepage | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Tax Subject PS6 - Partnership Returns

The rules and procedures for filing partnership returns can be a bit involved. This 10 hour course will help you review the filing rules and procedures of a partnership tax return. Tax School Homepage Student Instructions:Print this page, work on the questions and then submit test by mailing the answer sheet or by completing quiz online. Instructions to submit quiz online successfully: Step-by-Step check list Answer Sheet Quiz Online

Most forms are in Adobe Acrobat PDF format.

Partnership Return filing situation 1:

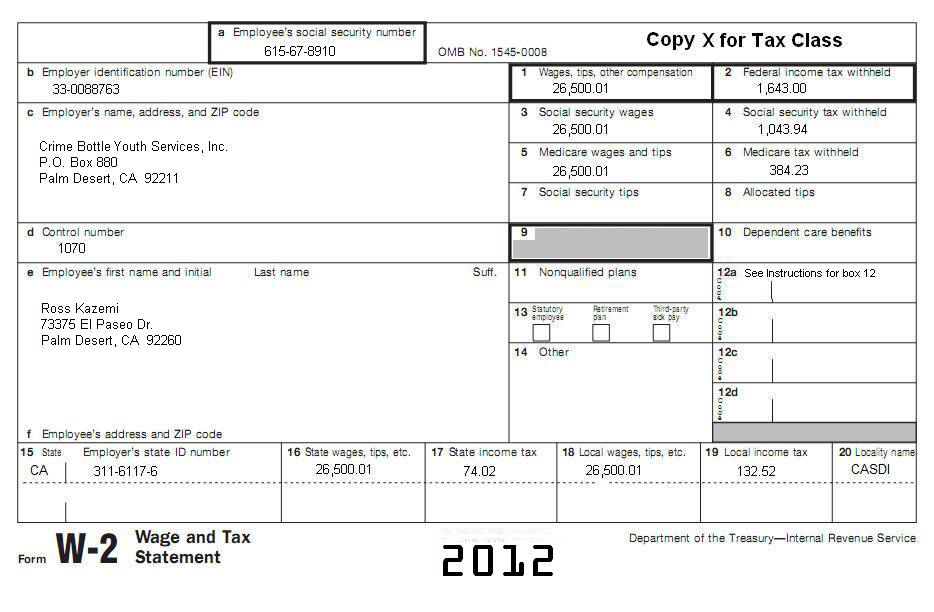

The Horse and Carriage Animal Feed Store (EIN 77-8901112) is a partnership between Ramona Kazemi (SSN 504-56-7890), Ross Kazemi (SSN 615-67-8910) and Shirin Delshad (SSN 511-23-4567) that specialize in farm animal feed supply. The partnership address is 36900 Cook Street, Palm Desert, CA 92211. No assets were placed in service in 2012. Information for Ramona and Ross Kazemi: Live at 73375 El Paseo Drive, Palm

Desert, CA 92260. Ramona paid $17,000 in federal estimated payments and another $4,100 in estimated payments to FTB. All payments were made on time every quarter. Ross paid $12,000 in federal estimated payments and another $2,000 in estimated payments to FTB. All payments were made on time every quarter.

Information for Shirin Delshad: Lives at 42335 Washington St., Apt 24, Palm Desert, CA 92211 Shirin is single and has no dependents. Shirin made $20,350 in federal estimated payments and another $4,000 to the FTB. All payments were made on time every quarter. According to the partnership agreement Ramona has a 40% capital and profits interest, Ross has 20% capital and profits interest, and Shirin has the remaining 40% capital and profits interest. Ramona and Shirin are both active in the business but Ross is not. The partnership has been in operation with the same owners since January 1, 2010. Shirin and the Kazemi family are not related. The partnership values its inventory using the accrual method and did not have any changes in methods in the current year. Purchases for the year were $157,418. Cash distributions to partners:

You will need the following financial statements to complete this partnership return.

Partnership Return filing situation 2:

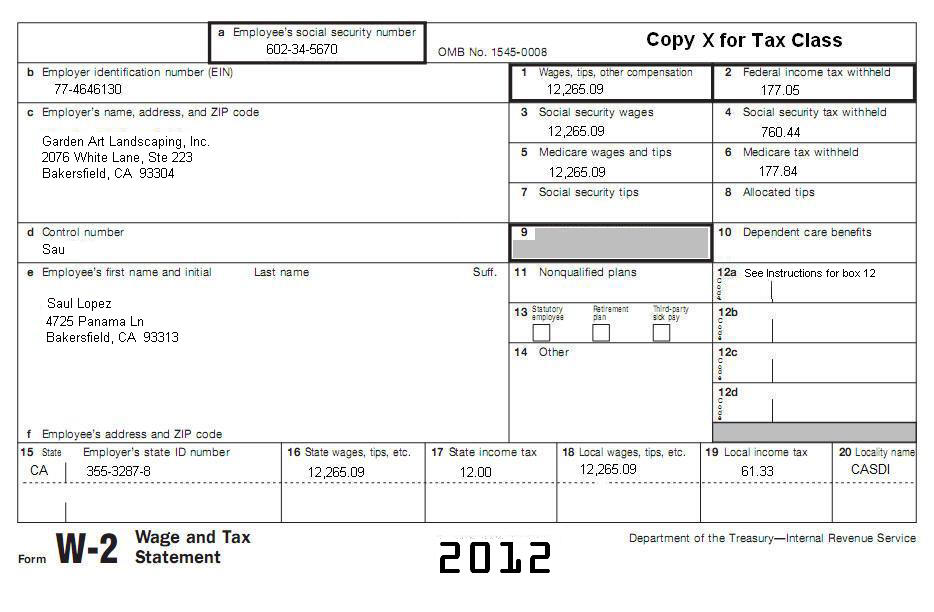

The Saul's Landscaping Arts (EIN 72-3456780) is a partnership between Saul Lopez (SSN 602-34-5670) and Erick Garcia (SSN 532-34-5678) that specialize in garden landscaping arts. The partnership's address is 8200 Stockdale Hwy, Ste M, Bakersfield, CA 93311. Saul has has 50% capital and profits interest and Erick has 50% capital and profits interest. They started business January 1, 2012. Both Saul and Erick were active in the business. They are operating under the cash method of accounting. Depreciation expense is for a power lawnmower placed in service when they started business on January 1, 2012 (5 year property). Saul is married to Conchita Perez (SSN 550-12-3454). They live at 4725 Panama Lane, Bakersfield, CA 93313. They have three children:

In addition to the partnership income, Saul received the following Form W-2:

Erick lives with his girlfriend but he is not married. They have a child together, whom Erick totally supports. Juan Garcia (SSN 627-89-1011 DOB June 6, 2012). Their address 4208 Rosedale Ave, Apt 39, Bakersfield, CA 93308. Erick is 26 years old.

You will need the following financial statements to complete this partnership return.

Answer the following questions as accurate as possible. Please pay attention to your answers as they will appear again on the "Quiz Online" part of this topic. Prepare your answers for these questions and then click on "Assignment" online in step 3 above when you are ready to submit them.

1. Look at the Form 1065 you prepared for the Horse and Carriage Partnership. What is the amount on Line 20?

A. $34,130 2. Look at the Form 1065 you prepared for the Horse and Carriage Partnership. What is on Schedule B Line 3b?

A. No 3. Look at the Form 1065 you prepared for the Horse and Carriage Partnership. What is on Schedule B Line 6d?

A. No 4. Look at the Form 1065 you prepared for the Horse and Carriage Partnership. What amount is on Schedule K Line 1?

A. $185,999 5. Look at the Form 1065 you prepared for the Horse and Carriage Partnership. What amount is on Schedule K Line 14a?

A. $185,999 6. Look at the Form 1065 you prepared for the Horse and Carriage Partnership. What names did you enter on Schedule B-1 Part II for Individuals or Estates Owning 50% or More of the Partnership?

A. Ramona

7. Look at the Form 1065 you prepared for the Horse and Carriage Partnership. What amount is on Form 4562 Line 17?

A. $0 8. Look at the Form 1065 you prepared for the Horse and Carriage Partnership. What amount is on Form 1125-A Line 6?

A. $10,000 9. Look at the Form 1065 you prepared for the Horse and Carriage Partnership. What amount is on Ross Kazemi's Schedule K-1 Line 14?

A. $27,200

10. Look at the Schedule E (Form 1040) you prepared for Shirin. What is the amount on Line 41?

A. $74,400 11. Look at the Schedule SE (Form 1040) you prepared for Shirin. What is the amount on Line 5?

A. $9,138 12. Look at the Schedule SE (Form 1040) you prepared for Shirin. What is the amount on Line 6?

A. $1,000 13. Look at the Form 1040 you prepared for Shirin. What is the amount on Line 36?

A. $74,400 14. Look at the Form 1040 you prepared for Shirin. What is the amount on Line 37?

A. $74,400 15. Look at the Form 1040 you prepared for Shirin. What is the amount on Line 55?

A. $10,874 16. Look at the Form 1040 you prepared for Shirin. What is the amount on Line 56?

A. $10,874 17. Look at the Form 1040 you prepared for Shirin. What is the amount on Line 73?

A. $1,900 18. Look at the Form 1065 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Line 8?

A. $40,075 19. Look at the Form 1065 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Line 14?

A. $740 20. Look at the Form 1065 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Line 16c?

A. $871 21. Look at the Form 1065 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Line 20?

A. $2,612 22. Look at the Form 1065 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Line 22?

A. $22,164 23. Look at the Form 1065 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Schedule B Line 3b?

A. No 24. Look at the Form 1065 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Schedule B Line 6d?

A. No 25. Look at the Form 1065 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Schedule K Line 1?

A. $22,164 26. Look at the Form 1065 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Schedule K Line 4?

A. $22,164 27. Look at the Form 1065 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Schedule K Line 14a?

A. $22,164 28. Look at the Form 1065 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Analysis of Net Income (Loss) line 1?

A. $22,164 29. Look at the Form 1065 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Analysis of Net Income (Loss) line 2a(ii)?

A. $22,164 30. Look at the Form 1065 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Schedule L Line 14?

A. $63,414 31. Look at the Form 1065 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Schedule M-1 Line 9?

A. $22,164 32. Look at the Form 1065 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Schedule M-2 Line 9?

A. $52,164 33. Look at the Form 4562 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Line 19b(g)?

A. $1,658 34. Look at the Form 4562 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Line 22?

A. $1,658 35. Look at the Form 1065 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Saul's Schedule K-1 Line 11?

A. $22,164 36. Look at the Form 1065 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Saul's Schedule K-1 Line 4?

A. $22,164 37. Look at the Form 1065 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Saul's Schedule K-1 Line 14?

A. $22,164 38. Look at the Form 1065 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Erick's Schedule K-1 Line 1?

A. $22,164 39. Look at the Form 1065 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Erick's Schedule K-1 Line 4?

A. $22,164 40. Look at the Form 1065 you prepared for Saul's Landscaping Arts Partnership. What is the amount on Erick's Schedule K-1 Line 14?

A. $22,164

41. Look at the Form 1040 you prepared for Saul. What is the amount on Line 37?

A. $12,265 42. Look at the Form 1040 you prepared for Saul. What is the amount on Line 56?

A. $1,361 43. Look at the Schedule E you prepared for Saul. What is the amount on Line 32?

A. $10,000 44. Look at the Form 1040 you prepared for Saul. What is the amount on Line 73?

A. $6,290 45. Look at the Form 1040 you prepared for Erick. What is the amount on Line 64a?

A. $5,000 46. Look at the Form 1040 you prepared for Erick. What is the amount on Line 73?

A. $931 Please Note: If you filled out the answers directly on this page, please print this page or write down the answers before you proceed to submit them

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Back to Tax School Homepage |