|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Back to Tax School Homepage | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Tax Segment T3 - Taxable and Nontaxable Income

Income can be received in the form of money, property or services. It is usually received as employee wages, fringe benefits, bartering, thorough partnerships, corporations (including S corporations), and royalties. Other items of income are disability pensions, insurance proceeds, and welfare and other public benefits. Usually income that is taxable is income that is received in exchange of services. Others are specifically includable by law. In this tax topic you will learn about the different kinds of income and whether they are taxable or nontaxable.Tax School Homepage Student Instructions: Print this page, work on the questions and then submit test by mailing the answer sheet or by completing quiz online. Instructions to submit quiz online successfully: Step-by-Step check list Answer Sheet Quiz Online

Most forms are in Adobe Acrobat PDF format.

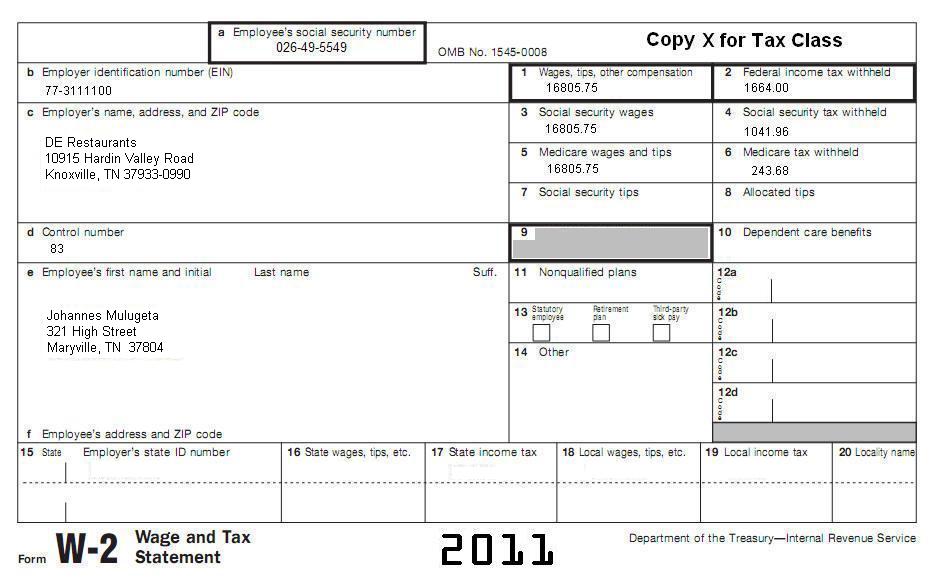

Yohannes owed Sears & Roebuck (Department store) $800. He fell behind on the bill and could not pay. To have Yohannes settle the debt, Sears offered to cancel $500 of the debt. Yohannes paid only $300 and the rest was forgiven. He paid rent at a government owned building that is exempt from tax. Get all their basic information from the following W2, including income information.

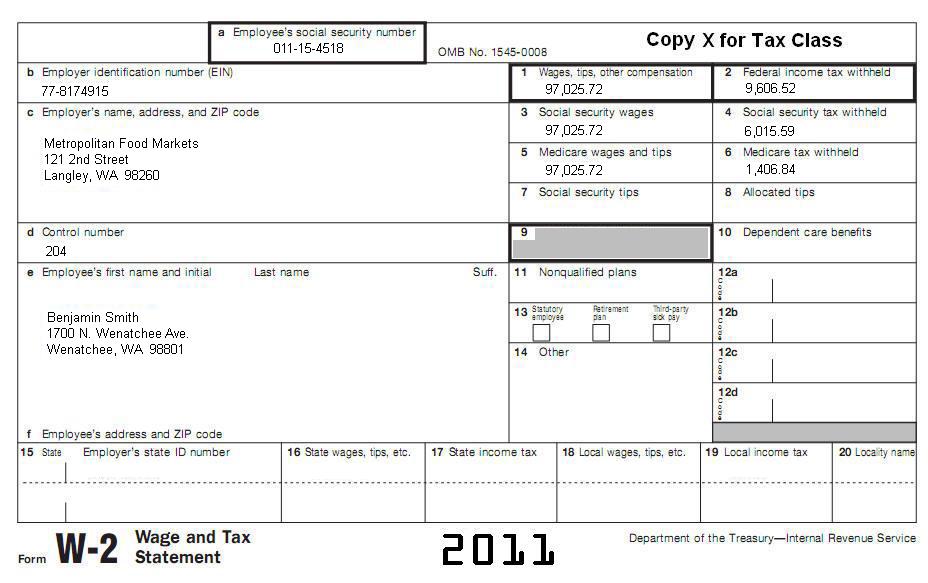

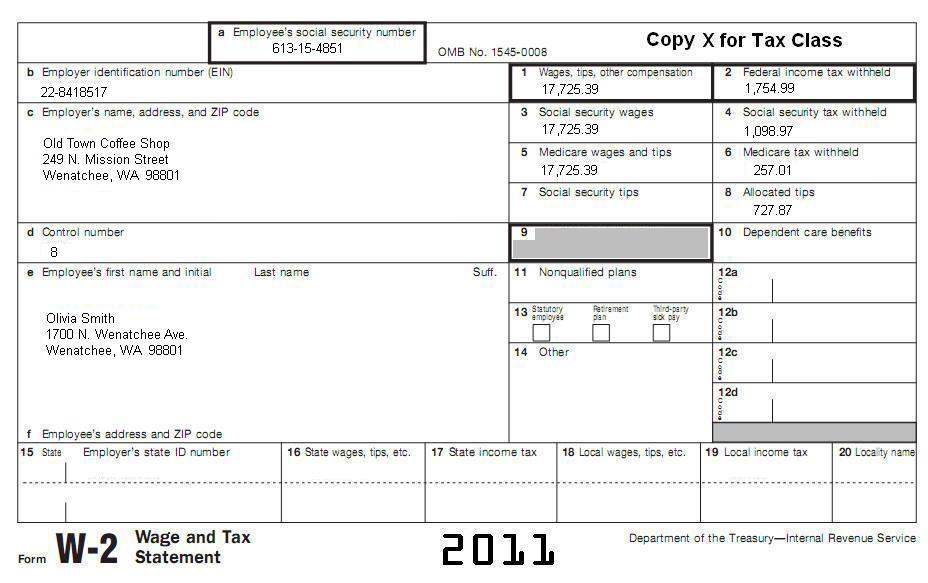

Tax Return filing Situation 2: Benjamin (Date of Birth 03/04/1968) and Olivia (Date of Birth 01/20/1969) are married and lived together all of 2011. Benjamin and Olivia had the following dependents in 2011. They fully supported them for all of 2011.

Benjamin and Olivia each have contributed $5,000 to a traditional IRA account on March 20, 2012. The following is taken from Olivia's record of tips:

Additionally, Olivia won money from a raffle held at work in the amount of $1,500. Benjamin and Olivia received the following for 2011. Basic information is correct on all Form W-2s.

After you have completed the above tax returns, answer the following questions:

1. Look at the Form 1040 you prepared for Yohannes Mulugeta. What is the amount on Form 1040, Line 7?

A. $20,359. 2. Look at the Form 1040 you prepared for Yohannes Mulugeta. What is the amount on Form 1040, Line 19?

A. $2,650. 3. Look at the Form 1040 you prepared for Yohannes Mulugeta. What is the amount on Form 1040, Line 21?

A. $2,650. 4. Look at the Form 1040 you prepared for Yohannes Mulugeta. What is the amount on Form 1040, Line 38?

A. $2,650. 5. Look at the Form 1040 you prepared for Yohannes Mulugeta. What is the amount on Form 1040, Line 40?

A. $5,800. 6. Look at the Form 1040 you prepared for Yohannes Mulugeta. What is the amount on Form 1040, Line 42?

A. $5,800. 7. Look at the Form 1040 you prepared for Yohannes Mulugeta. What is the amount on Form 1040, Line 44?

A. $5,800. 8. Look at the Form 1040 you prepared for Yohannes Mulugeta. What is the amount on Form 1040, Line 62?

A. $1,664. 9. Look at the Form 1040 you prepared for Yohannes Mulugeta. What is the amount on Form 1040, Line 73?

A. $1,664. 10. Look at the Form 1040 you prepared for Yohannes Mulugeta. What is the amount on Form 1040, Line 74a?

A. $1,664. 11. Look at the Form 1040 you prepared for Benjamin and Olivia. What is the amount on Form 1040, Line 7?

A. $117,951. 12. Look at the Form 1040 you prepared for Benjamin and Olivia. What is the amount on Form 1040, Line 21?

A. $117,951. 13. Look at the Form 1040 you prepared for Benjamin and Olivia. What is the amount on Form 1040, Line 22?

A. $117,951. 14. Look at the Form 1040 you prepared for Benjamin and Olivia. What is the amount on Form 1040, Line 32?

A. $10,000. 15. Look at the Form 1040 you prepared for Benjamin and Olivia. What is the amount on Form 1040, Line 36?

A. $8,000. 16. Look at the Form 1040 you prepared for Benjamin and Olivia. What is the amount on Form 1040, Line 38?

A. $10,000. 17. Look at the Form 1040 you prepared for Benjamin and Olivia. What is the amount on Form 1040, Line 40?

A. $10,000. 18. Look at the Form 1040 you prepared for Benjamin and Olivia. What is the amount on Form 1040, Line 42?

A. $25,900.

19. Look at the Form 1040 you prepared for Benjamin and Olivia. What is the amount on Form 1040, Line 44?

A. $10,244.

20. Look at the Form 1040 you prepared for Benjamin and Olivia. What is the amount on Form 1040, Line 45? (Complete 1040A AMT Worksheet or Form 6241 to know for sure).

A. $25,900. 21. Look at the Form 1040 you prepared for Benjamin and Olivia. What is the amount on Form 1040, Line 51?

A. $25,900. 22. Look at the Form 1040 you prepared for Benjamin and Olivia. What is the amount on Form 1040, Line 54?

A. $5,000. 23. Look at the Form 1040 you prepared for Benjamin and Olivia. What is the amount on Form 1040, Line 55?

A. $5,244. 24. Look at the Form 1040 you prepared for Benjamin and Olivia. What is the amount on Form 1040, Line 57?

A. $5,244. 25. Look at the Form 1040 you prepared for Benjamin and Olivia. What is the amount on Form 1040, Line 61?

A. $5,285. 26. Look at the Form 1040 you prepared for Benjamin and Olivia. What is the amount on Form 1040, Line 62?

A. $5,244. 27. Look at the Form 1040 you prepared for Benjamin and Olivia. What is the amount on Form 1040, Line 65?

A. $0. 28. Look at the Form 1040 you prepared for Benjamin and Olivia. What is the amount on Form 1040, Line 72?

A. $0. 29. Look at the Form 1040 you prepared for Benjamin and Olivia. What is the amount on Form 1040, Line 73?

A. $0. 30. Look at the Form 1040 you prepared for Benjamin and Olivia. What is the amount on Form 1040, Line 74a?

A. $6,077. If you are answering the questions directly on this page, make sure you print them before you click on "Assignment" in step 2 above. If you don't have a printer, then write the answers down before you proceed

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Back to Tax School Homepage |