|

|

| Back to Tax School Homepage |

|

Tax Segment T1 - Introduction to Taxation

There was a time when there was no income tax. The taxing process graduated slowly to what it is now. At one point there was a question of the constitutionality of taxation. Taxes are a necessity. How else can a nation survive and prosper? This topic is your introduction to taxation. In it you will find the very basic tax principles that are necessary to prepare tax returns. Upon reading the material for topic 1, you will encounter almost every topic covered in the basic certification course including the mentioning of publications used in this course. Due to ethics and tax updates requirements that must be met, everything in the reading material matters (everything is game, fine print, help to taxpayers, disclosures and the various tax worksheets). Tax School Homepage Student Instructions: Print this page, work on the questions and then submit test by mailing the answer sheet or by completing quiz online. Instructions to submit quiz online successfully: Step-by-Step check list Answer Sheet Quiz Online

Most forms are in Adobe Acrobat PDF format.

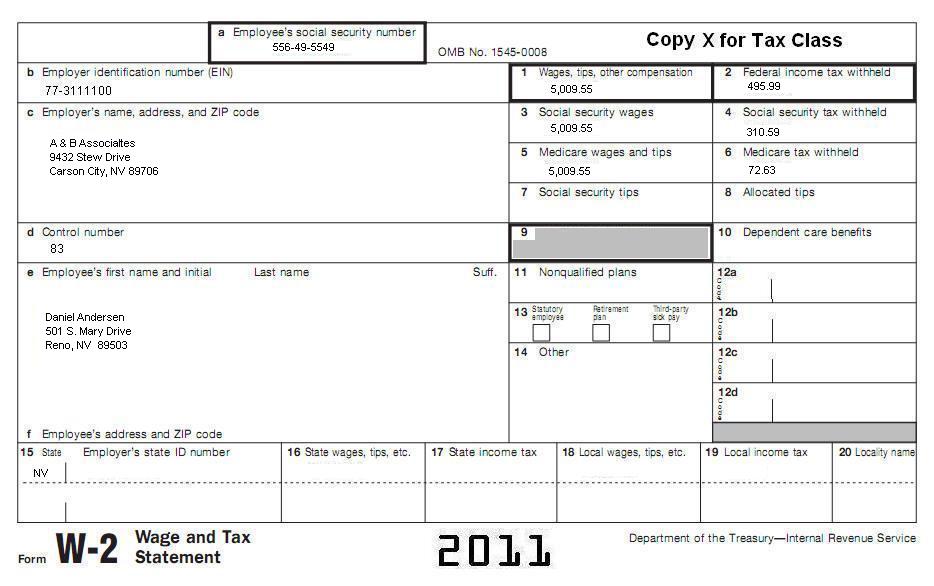

You will need to prepare a tax return for your friend Daniel and another return for your friend James. Their information is stated separately in each of the following situations: Tax Return 1: Please prepare Form 1040EZ for Daniel. Here is Daniel's W-2. All income and identifying information for Daniel on this W-2 is correct and current.

Daniel is 27 years old and is not married. Daniel cannot be claimed as a dependent on another tax return. He received $3,400 in unemployment benefits for the year.

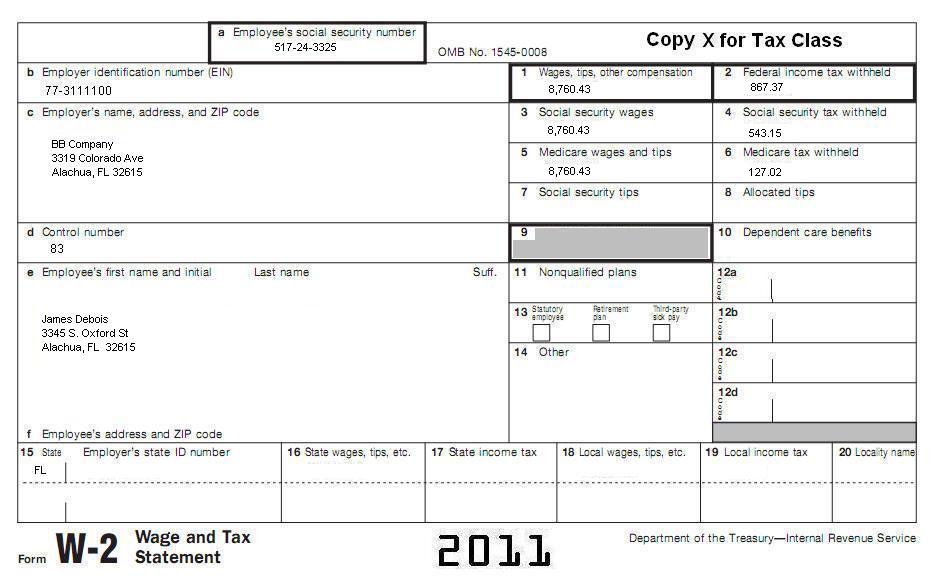

Tax Return 2: Please prepare Form 1040EZ for James. Here is James' W-2. All income and identifying information for James on this W-2 is correct and current.

In addition, James married Sarah Baker on December 22, 2011. They did not live together at any time during the year. James and his wife are both over age 65. In January 2012, James received a Form SSA-1099 showing net benefits of $9,700 in box 5 for 2011 tax year. James also received unemployment compensation of $1,800 and taxable interest income of $450. Sarah did not work in 2011. Her SSN is 658-65-0935. Sarah received a Form SSA-1099 showing net benefits of $1,400 in box 5. James wants to know if he can take the EIC on his tax return. Neither James nor Sarah received any tax-exempt interest income. They cannot be claimed as dependents on another tax return.

1. Look at the Form 1040EZ you prepared for Daniel. What is the amount on line 1?

A. $5,009. 2. Look at the 1040EZ form you prepared for Daniel. What is the amount on line 3?

A. $0. 3. Look at the 1040EZ form you prepared for Daniel. What is the amount on line 4?

A. $8,410. 4. Look at the 1040EZ form you prepared for Daniel. What is the amount on line 5?

A. $19,000. 5. Look at the 1040EZ form you prepared for Daniel. What is the amount on line 6?

A. $9,500. 6. Look at the 1040EZ form you prepared for Daniel. What is the amount on line 7?

A. $495.99. 7. Look at the 1040EZ form you prepared for Daniel. What is the amount on line 8a?

A. $0. 8. Look at the 1040EZ form you prepared for Daniel. What is the amount on line 9?

A. $880. 9. Look at the 1040EZ form you prepared for Daniel. What is the amount on line 10?

A. $0. 10. Look at the 1040EZ form you prepared for Daniel. What is the amount on line 11a?

A. $496. 11. Look at the 1040EZ form you prepared for Daniel. What is the amount on line 12?

A. $0. 12. Look at the 1040EZ form you prepared for James. What is the amount on line 1?

A. $8,760.43 13. Look at the 1040EZ form you prepared for James. What is the amount on line 2?

A. $450. 14. Look at the 1040EZ form you prepared for James. What is the amount on line 3?

A. $0. 15. Look at the 1040EZ form you prepared for James. What is the amount on line 4?

A. $8,760. 16. Look at the 1040EZ form you prepared for James. What is the amount on line 5?

A. $9,500. 17. Look at the 1040EZ form you prepared for James. What is the amount on line 6?

A. $0. 18. Look at the 1040EZ form you prepared for James. What is the amount on line 7?

A. $7,990. 19. Look at the 1040EZ form you prepared for James. What is the amount on line 8a?

A. $464. 20. Look at the 1040EZ form you prepared for James. What is the amount on line 9?

A. $867. 21. Look at the 1040EZ form you prepared for James. What is the amount on line 10?

A. $0. 22. Look at the 1040EZ form you prepared for James. What is the amount on line 11a?

A. $1,241. 23. Look at the 1040EZ form you prepared for James. What is the amount on line 12?

A. $1,241. If you are answering the questions directly on this page, make sure you print them before you click on "Assignment" in step 2 above. If you don't have a printer, then write the answers down before you proceed

|

| Back to Tax School Homepage |